Why Food & Beverage is the most popular sector for sponsoring NBA franchises

June 1, 2023

While most eyes around the NBA are turning towards Denver with the city hosting Game 1 of their first NBA finals tonight, we have taken a step back to give you a full breakdown of who is sponsoring the 30 NBA franchises.

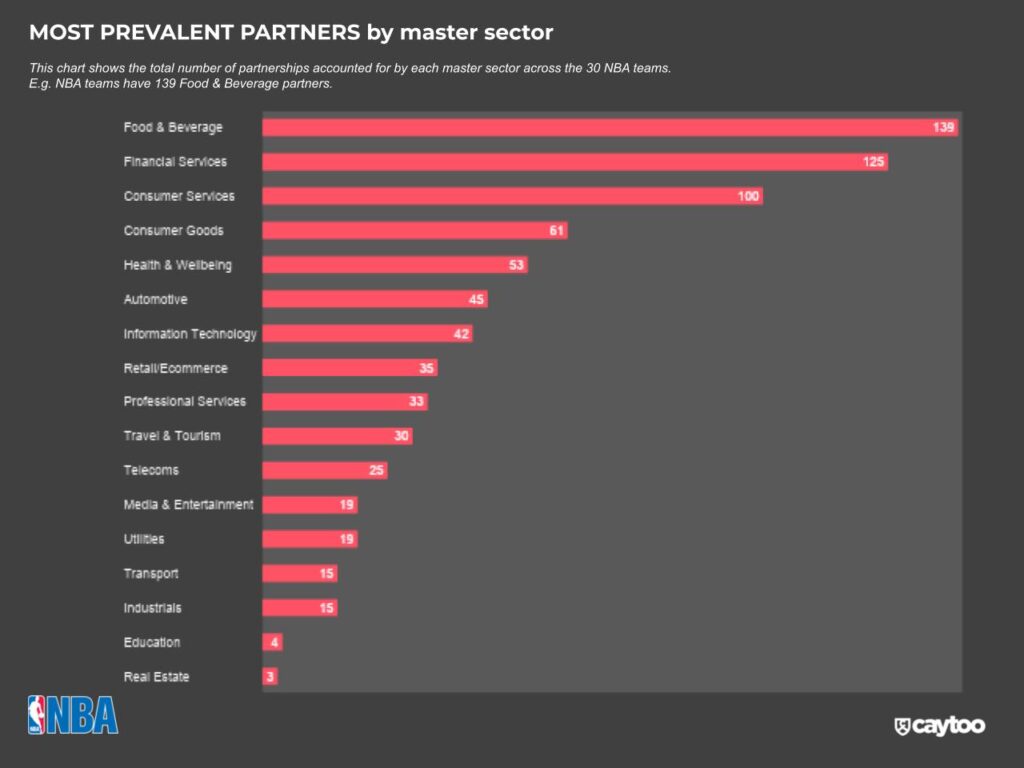

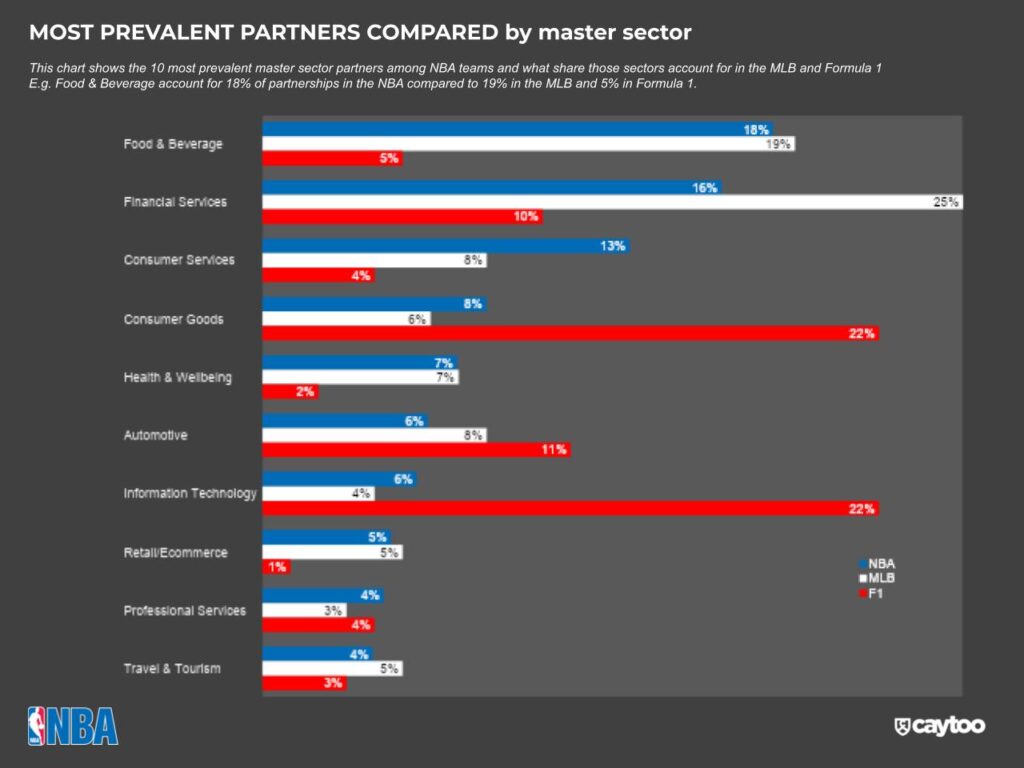

Food & Beverage (F&B) (18%), Financial Services (16%) and Consumer Services (13%) are the most prevalent sectors partnering with NBA teams, accounting for nearly half of all sponsors.

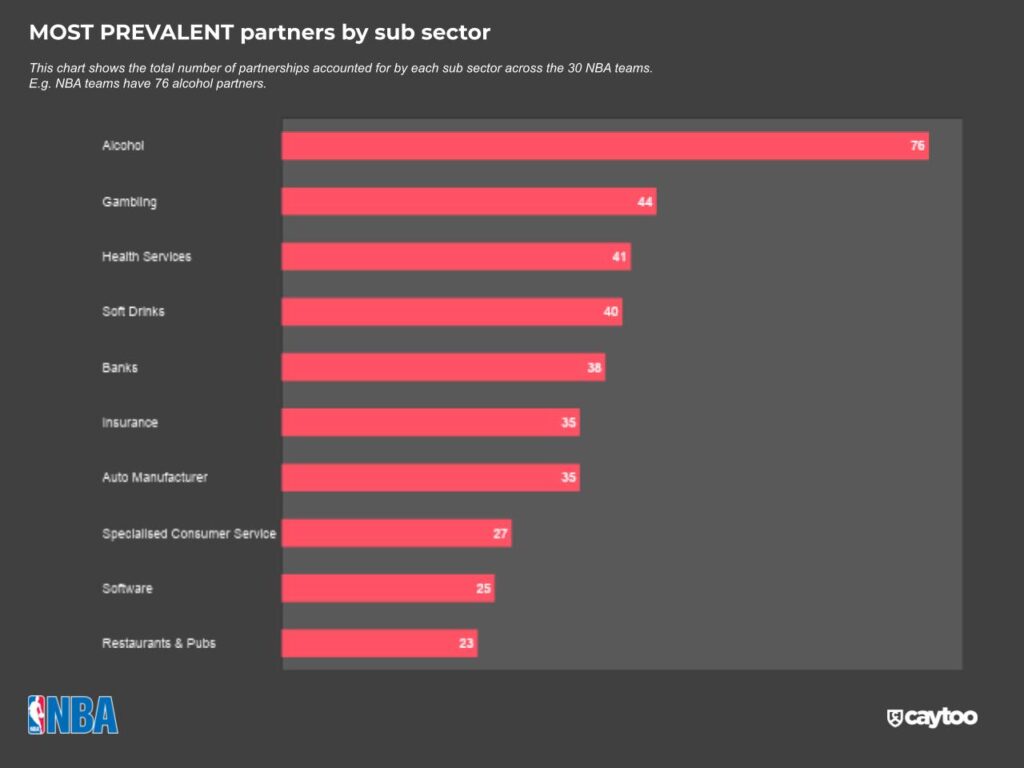

F&B partnerships are driven by Alcohol and Soft Drinks, the former being the most dominant sub-sector by far with 76 partnerships, followed by gambling at 44. Like the MLB, Alcohol brands account for around 10% of all partnerships but a significant difference is that in the MLB, beer brands account for around 86% of alcohol partners compared to just 50% in the NBA. This shows that spirits and wine brands clearly consider basketball to be a much better avenue to reach their drinkers than baseball.

In an Atlantic article in 2014, Derek Thompson, looked into the different demographics that watch US sports. In a time where brands are increasingly aware of who they want to target to make sure their advertising dollars, a look at these demographics could explain why certain sectors target different sports. As of 2014 the NBA had a 45% black, 45% under 34 and 70% male viewership, it would be surprising if these figures had moved much in the last decade. If so, it’s more likely to be more concentrated around these demographics. Over in the MLB, the TV audience was 83% white, 50% over 55 and 70% male. Different audiences, different sponsors.

Financial Services is driven by insurance and banks – much like it is in the MLB. However, in the NBA they account for significantly less share (16%) than in the MLB (25%). This suggests that baseball is more likely to be seen by potential FS partners as a better way to differentiate their ‘drier’ product sectors and drive loyalty through team loyalty than basketball.

Consumer Services is driven by Gambling and Specialised Consumer Services. The sector accounts for a higher share of partners (13%) than in the MLB (6%). Notably, gambling is the second most prevalent sub-sector in the NBA, much higher than that in both the MLB (ranked 7th) and Formula 1 (19th). In the NBA, Gambling is driven by fantasy sports brands, such as FanDuel and DraftKings, which account for a much larger share of Gambling brands than in the MLB.

Click here to find out more about the work being done by caytoo