The Sport Apparel Drama – Adidas grow, Nike, Puma UA Struggle

April 25, 2024

“Carlo De Marchis ‘a guy with the yellow scarf pens down this month’s Business Index. Lots of big movers such as TKO, Guild eSports and Tencent but the focus is on apparel and adidas’ recent share price surge”

How come? New CEO? Rebound? Sponsorship deals? Streetwear coolness?

Full disclosure: I wear Adidas most days, Munich, Hamburg, SL 72 etc…

Let’s dig in!

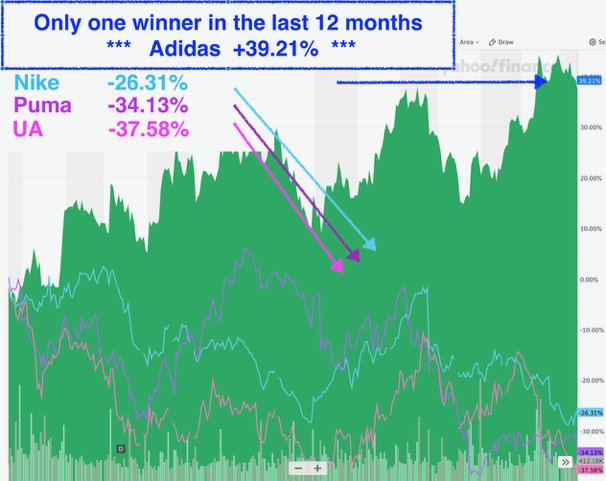

In a challenging period for the athletic footwear and apparel industry, Adidas has emerged as a standout performer. The German sportswear giant’s stock has climbed over 30% year-to-date, handily outpacing the broader market and key rivals like Nike, Puma and Under Armour.

Adidas’ resurgence comes on the heels of a difficult 2023, marred by the company’s costly split with rapper and designer Kanye West. The breakup over West’s antisemitic comments forced Adidas to abandon its lucrative Yeezy line, leading to the company’s first annual loss in over 30 years.

However, Adidas has rebounded impressively in 2024. The company’s fiscal Q1 results, released in a preliminary announcement on April 18, revealed a 4% increase in revenue to €5.5 billion, beating analyst expectations. Even more encouragingly, operating profit soared to €336 million from just €60 million a year earlier. Gross margins also expanded by over 6 percentage points to 51.2%.

The strong start to the year prompted Adidas to significantly raise its full-year guidance. The company now projects mid-to-high single digit revenue growth (up from mid-single digits previously) and operating profit of around €700 million, 40% higher than its prior forecast of €500 million. Analysts applauded the upgraded outlook, with Telsey Advisory Group’s Cristina Fernandez increasing her price target on Adidas shares to €225.

CEO Bjørn Gulden, who took the helm in January 2023, looks to be the steadying presence Adidas needs. If Adidas can build on its encouraging start to 2024, invest judiciously in product innovation and marquee partnerships, and avoid any more unforced errors, the company has a good shot at sustaining its stock market outperformance.

Adidas appears to be executing more effectively on the fashion and influencer partnerships that drive the athletic industry. While Nike and Under Armour have leaned heavily into performance sports like basketball, Adidas has cultivated popular streetwear collaborations with designers like Pharrell Williams and Sean Wotherspoon that generate buzz.

Adidas is also pursuing high-profile sponsorships, including a reported new kit deal with Liverpool F.C. starting in the 2025-26 season, swiping the Premier League club away from Nike. However, the company faces brand challenges, particularly on its home turf. In a major blow, Adidas lost its position as the German national soccer team’s kit supplier to Nike starting in 2027, ending a 70-year relationship. Some saw it as a stinging rebuke to a homegrown brand in favor of a foreign competitor. “I would have liked a bit more local patriotism,” lamented Germany’s economy minister.

Several other factors are fueling Adidas’ momentum. Robust demand for retro styles like the Samba and Gazelle is attracting consumers and driving sales growth. Adidas also still managed to generate €200 million in profitable Yeezy inventory liquidation in 2023 and early 2024, putting that turbulent chapter behind it. With major sporting events like the Olympics and Euro 2024 on tap, Adidas is well-positioned to capitalize on the heightened interest.

Adidas’ turnaround stands in stark contrast to the headwinds battering competitors Nike and Puma. Both companies recently warned of a slowdown in the athletic footwear and apparel market. Supply chain issues, weakening consumer demand, and unfavorable currency impacts are all weighing on their financial results.

In its most recent quarter, Nike’s revenue declined 1% year-over-year, with North American sales down 5%. The company is undergoing significant layoffs as it looks to cut $2 billion in costs. Puma has also felt the sting of macroeconomic pressures, especially from the devaluation of the Argentine peso in one of its key growth markets.

Under Armour, meanwhile, continues to lose ground to larger rivals. The company is struggling to gain traction with its flagship footwear like the Curry brand as it remains more reliant on the intensely competitive North American market.

The biggest contributor to Adidas’ 2024 comeback is undoubtedly the waning impact of the Yeezy debacle. With that painful and expensive episode receding, the company can refocus on its core offerings and storytelling.

The athletic footwear and apparel space will likely remain fiercely competitive and sensitive to shifting consumer tastes and spending. Companies will have to deftly navigate challenges from continued supply chain disruptions to online distribution to increasing calls for environmental and social responsibility.

In that context, Adidas’ strong 2024 rebound is all the more impressive. If the company can stay on offense, as Gulden urges, and keep making prudent strategic decisions, it has a chance to solidify its recent gains. After a humbling period, Adidas is showing a resilience and agility that the market is rewarding. The German giant looks ready to run again.

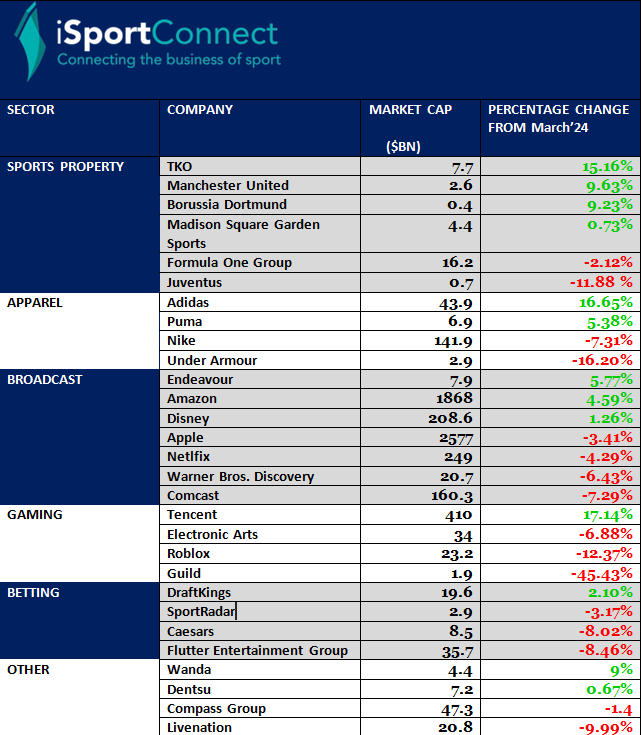

Here’s the full index: