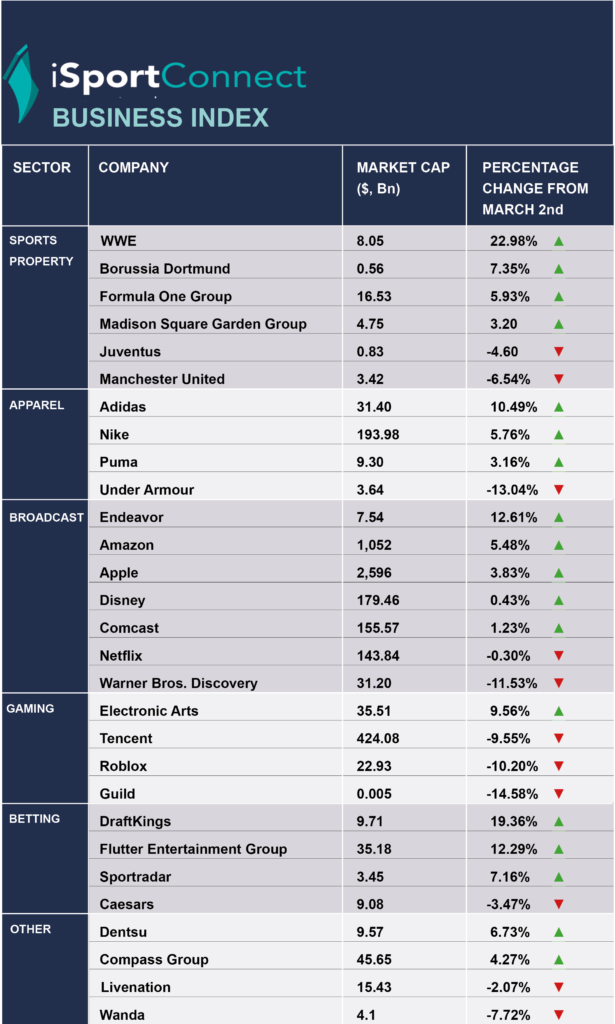

The Bottom Line – WWE share price rises by over 20%

April 27, 2023

In this month’s iSportConnect Business Index Ian Whittaker, Founder and MD of Liberty Sky Advisors, and twice City AM Analyst of the Year, looks into the WWE and Endeavor deal and what is going on at Manchester United.

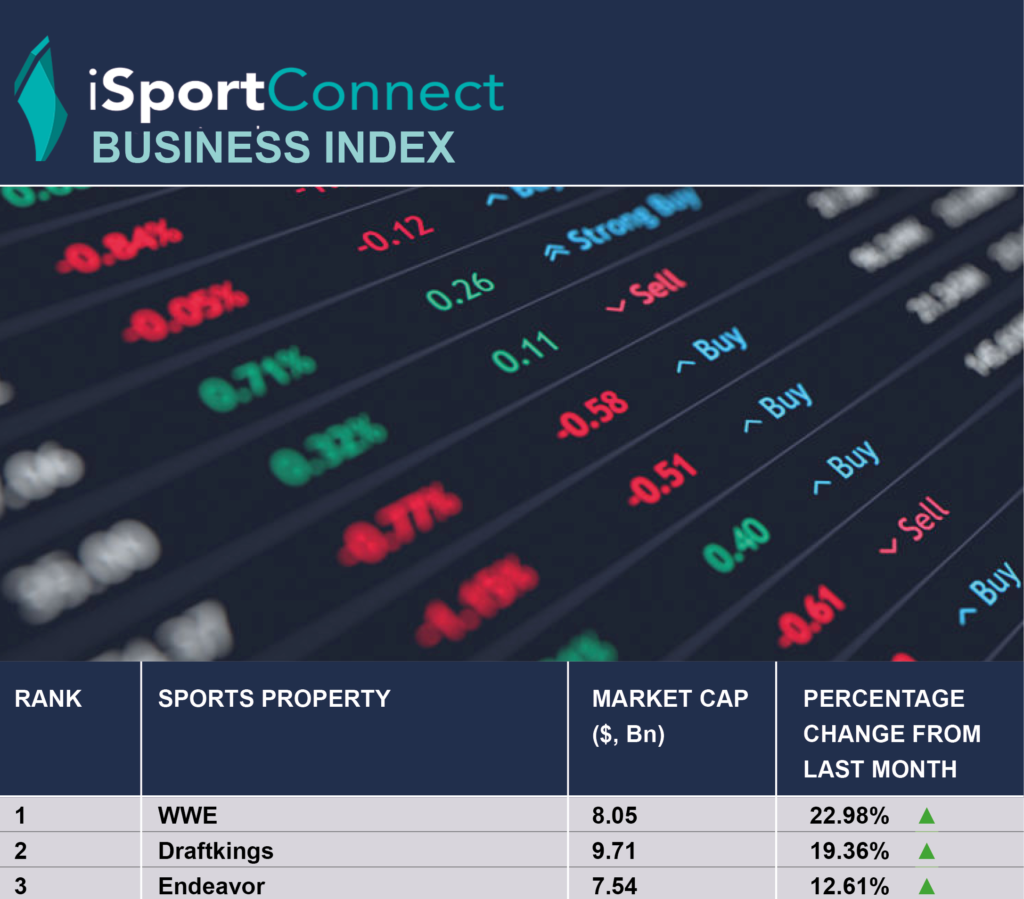

There has been a lot happening in the iSC Top 30 Sports Index this month, with a number of major moves in the space. Probably the major item has been the tie up between WWE and Endeavor’s UFC which has been very well received by the market which sees a number of opportunities from the $21bn combination. Both sides have arguably a lot to earn from each other – WWE leads in consumer products while UFC does in sponsorship. Bringing the two together the transfer of best practice but also give them much bigger muscle when it comes to renegotiating media rights, which makes up over 70% of revenues. Given the growth of ‘non-traditional’ sports such as UFC amongst younger audiences, the combined entity should be in a prime position to get more for its rights, especially given the entry of the Tech giants into the sports rights arena and the desire of other players such as Netflix to look at alternatives to the main sporting rights.

Elsewhere, Flutter rose by more than 12%, mainly driven by hopes that it will move its listing from London to New York, which should (presumably) lead to a higher valuation for the stock. But more generally, the sentiment around the gambling space remains positive with Draft Kings rising nearly 20% as investors continue to be positive on the potential opportunities of the US market. Within Media and Tech, WBD has fallen as investors digested the implications of the investor day, which saw HBO dropped from the Max+ brand, causing much discussion about the drivers behind the move while Tech has continued its gradual recovery, which is likely to be boosted by the results coming through from Alphabet (Google), Meta (Facebook) and Microsoft, whose results have all pleased investors. In the Retail space, Under Armour continues to suffer over fears around inventory and future revenue trends but the ‘controversy’ over Nike’s campaign featuring Dylan Mulvaney has not impacted the share price, more the opposite.

And what about the saga at Manchester United? Well, that continues. The latest news reports suggests the Glazier Family may be looking for alternative financing that allows them to remain owners which has impacted already concerned sentiment about whether a sale would actually take place as the Glaziers demand a higher price. This one continues to roll and, while it looks like Manchester United are heading back to the Champions League (as long as they do not suffer an end of season collapse), the continued uncertainty will raise fears about the longer-term future.