Streaming Leaders Post Subscriber Gains But Profitability Remains Elusive

November 9, 2023

Carlo De Marchis, ‘a guy with a scarf’ pens down this month’s business index.

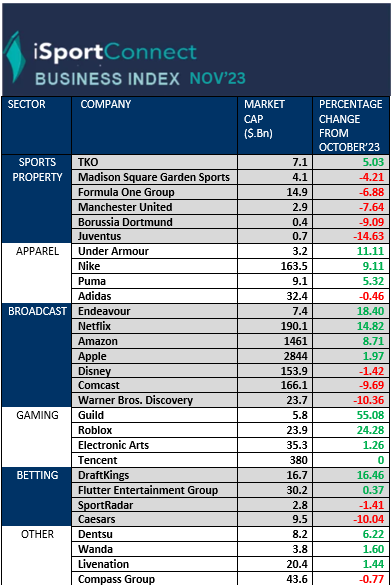

Overall our index sees more positives than in the past months but the Sports category is the one doing less well. We want to focus our attention on the media and streaming sector with Netflix seemingly doing the right things in the current scenario and is up nearly 15% on the month alone. That’s a big move and continues a strong performance as Netflix is up around 50% this year vs the S&P 15%. .

Another notable winner is Draftkings but that we will cover in the next episode.

The latest quarterly earnings reports from major streaming platforms offer crucial insights into the state of the industry. By analyzing subscriber, revenue and profitability data, we can assess which players like Netflix and Disney are leading the pack. Streaming’s transition continues, but these financial results help gauge progress monetizing users amid economic uncertainty. Though challenges remain, the numbers reveal how media giants are adapting their business models to gain dominance as consumer behavior shifts. The earnings spotlight key inflection points in streaming’s competitive evolution.

What we learned:

- In brief we were surprised by subscribers numbers going up and in many cases beating estimates

- Price hiking has not scared too many customers

- Password sharing restriction has not scared too many customers

- The hybrid AVOD/SVOD/FAST model is in the works, too early to judge

Major streaming platforms Amazon, Disney, and Netflix reported third quarter earnings this month, highlighting ongoing subscriber momentum amid intensifying competition for market share. However, turning streaming to profit remains an uphill battle.

Netflix remains the leader in the streaming space with impressive Q3 subscriber additions showing its continued momentum. The company added 8.8 million global paid members, ending the quarter with over 247 million total subscribers. Growth was fueled by hit content like Stranger Things and Virgin River as well as new initiatives around advertising and account sharing. Netflix also posted improved profitability driven by price hikes and subscription monetization. However, the company still faces rising competitive threats as deep-pocketed rivals like Disney, Apple and Amazon ramp up investments in exclusive original content.

Though Netflix retains pole position for now, its content costs remain extremely high at over $17 billion per year. As economic conditions tighten and consumers reel in spending, Netflix will need to judiciously balance content budgets and regional strategies to maintain growth. Profitability gains are encouraging but larger challenges loom to defend its streaming dominance worldwide in the years ahead. Overall, Netflix remains the giant to beat, but its long-term trajectory will be shaped by how well it can evolve its business model and avoid missteps against hungry competitors.

Amazon also posted robust ad sales of $12 billion, up 26% year-over-year. This sets the stage for the retail giant to introduce an ad-supported version of Prime Video in 2024, further diversifying revenue.

Disney+ grew subscribers 12% to 152 million, but at a slowing rate of just 4 million adds last quarter. High content and marketing costs continue to weigh on profitability. Disney’s direct-to-consumer unit posted a $387 million loss for Q3.

Results underscore streaming’s transition pains. Subscriber gains highlight platforms’ growing scale and demand for on-demand video. Amazon and Netflix in particular showcased their ability to monetize engaged users through ads, price hikes and account policies.

But turning a profit remains an uphill battle, especially for Disney. With economic uncertainty ahead, financial discipline and savvy spending will determine which players emerge on top in the streaming wars.

For now, Netflix and Amazon look best positioned given their subscriber monetization progress and ad capabilities. But Disney’s unmatched brands and IP present an opportunity to play catchup if the company can judiciously rein in costs.

The path ahead will test streaming’s leaders as consumer budgets tighten. But quarterly momentum underscores these giants’ pole position as cord cutting accelerates. Where streaming’s profit puzzle will ultimately land is still coming into focus.

Looking into the categories

Streaming:

- Divergent trajectories with players like Netflix and Paramount+ adding subscribers but also facing cost/profitability pressures.

- Roku growing accounts and revenue signaling advertising rebound.

- Pay-TV providers like Dish and Altice continue to lose subscribers to cord-cutting.

Media/Content:

- Traditional media firms face growth struggles compared to digital/streaming.

- Ad measurement provider Comscore saw modest revenue decline.

- AMC Networks grew streaming revenue but overall company under pressure.

Tech:

- Cloud services firms like Akamai saw solid enterprise security revenue but media delivery lagged.

- Apple saw iPhone sales growth but slowdowns in other units like Mac.

- Vimeo struggled with bookings/pipeline especially among SMB customers.

Overall themes:

- Streaming services and digital media outperforming traditional media.

- Economic uncertainty creating churn – winners adapt and highlight value.

- Cost control and financial discipline critical in turbulent environment.

- Choppy conditions persist but opportunities exist for firms able to execute.

AOB – Crypto back in fashion?

It will be very interesting to see if the momentum gathering in the crypto markets has any effect on areas of the Index. For those not watching Bitcoin (that tends to be the wider barometer) it has pretty much doubled this year and has steadily risen all year. It’s been out of the news and is it a coincidence that Roblox has also been very strong recently? One to watch….

Here’s the full index: