Streaming and Apparel Valuations Climb; Sports Properties and Betting Slip

December 7, 2023

Carlo De Marchis, ‘a guy with a scarf’ pens down this month’s business index.

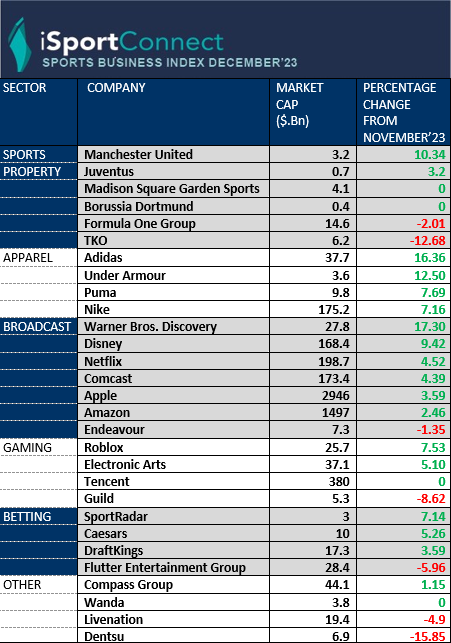

Fun fact: This month there is a lot of green on the iSportConnect Business Index! This does match the overall global market sentiment of positivity.

Ones to watch: Man Utd UP, Apparel sector is UP (holidays season?), TKO down

The latest market capitalization snapshot for major sports-affiliated industries reveals a strong showing from broadcasters and brands, but a retrenchment for properties and betting outfits.

In the broadcasting category, valuations grew 3.4% over the past month to over $5 trillion. The combined force of television stalwarts and streaming giants like Apple, Amazon, Disney and more continues to yield impressive gains, even in a turbulent economic climate. With Warner Bros. Discovery’s recent merger fueling more content and reach, the category appears poised for sustained growth.

Apparel also saw valuation expansion, with an 8% increase highlighting the endurance of performance brands like Nike, Adidas and Puma. Through technical innovation, lifestyle resonance and star partnerships across sports, the apparel giants continue to drive profits amidst broader retail contraction.

However, sports real estate struggled, with venue and team owners seeing combined market caps fall 3.1% to $29.2 billion. Formula One, Madison Square Garden Sports all trended negatively, reflecting macroeconomic pressures on live events. Sports betting also declined 0.9%, with regulatory uncertainty around firms like Flutter Entertainment’s FanDuel persisting. The only standout positive was Man Utd – will we be getting closer to a deal between the Glazers and Sir Jim Ratcliffe?

Other insights include gaming’s mild 0.7% uptick showing resilience for Electronic Arts and others. Compass Group’s steady football stadium and arena food service business boosted “other” related markets slightly as well.

Keep an eye on Roblox. Yes the shares are benefitting from the huge rally in Crypto (BTC is well over 100% higher than a year ago) but they are also connecting their online world back into the physical world. This could be a gamechanger and the first real example of the “Phygital’ world working. One to watch in 2024.

In summary, sector rivals broadcasting and apparel are leveraging content and branding to lift valuations, while economic uncertainty weighs on venues, teams, and sportsbooks. With these trajectories diverging widely, the interplay between streaming dollars, live attendance, licensed goods sales, and betting handle will remain crucial to track.

Here’s the full index: