So much happened in the last few weeks and the market reacted well

February 15, 2024

Carlo De Marchis, ‘a guy with a scarf’ pens down this month’s business index.

Let’s see who did well and try to find some reasons for this good moment.

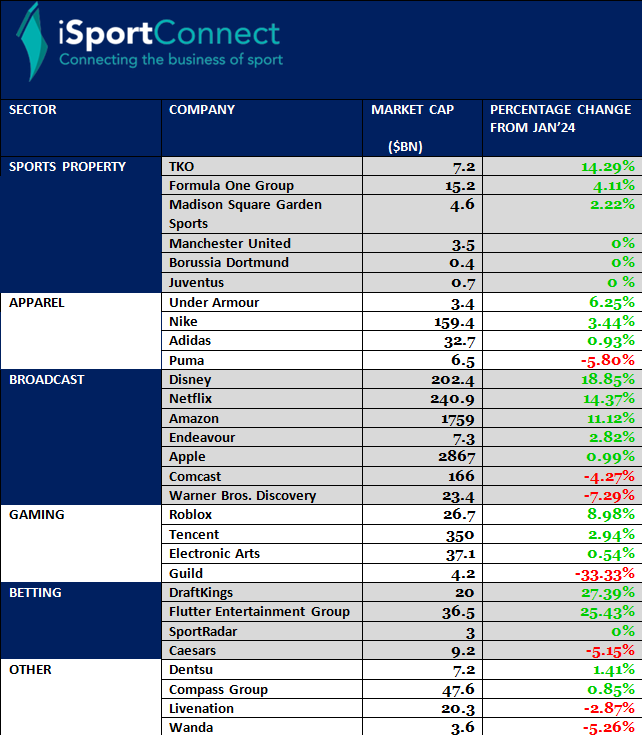

Media, sport and betting did well. Check this list of increased market cap in the last month.

Related news that may have an impact are:

– Disney, Fox and CBS announcing a new sport streaming JV

– Amazon started adding ads to Prime video and added and ads-free paid package

– NFL Super Bowl betting reached record

– WWE (TKO) did a deal with Netflix for their “Raw” show from 2025

– Netflix earning will beat expectations

– Roblox is growing 20% on all metrics

– Amazon wins exclusive streaming rights for NFL playoff game

| DraftKings | +27.39% |

| Flutter Entertainment Group | +25.43% |

| Disney | +18.85% |

| Netflix | +14.37% |

| TKO | +14.29% |

| Amazon | +11.12% |

| Roblox | +8.98% |

DraftKings reports Q4 2022 results after the bell tomorrow. The fantasy sports and betting leader has a strong history of trouncing revenue estimates, beating by 9.3% on average over the past two years. Last quarter, DraftKings posted blowout 57.4% year-over-year revenue growth to $790 million, exceeding forecasts by 12.9%. For Q4, analysts expect slowed 44.6% top-line expansion to $1.24 billion and $0.18 adjusted EPS. While Wall Street has turned more bearish recently with multiple downward revisions, DraftKings has consistently left doubters in the dust. With gaming peers like MGM Resorts and Boyd Gaming also recently topping projections, expectations are elevated heading into tomorrow’s high-stakes release.

FanDuel parent company Flutter Entertainment listed on the New York Stock Exchange (NYSE) on Monday under the ticker symbol FLUT. The move gives Flutter and its leading US sports betting brand FanDuel greater access to capital markets and US investors. It also positions Flutter to compete more directly with DraftKings, currently the largest US public pure-play in the rapidly growing sports betting industry. FanDuel already leads with 43% US market share in sports betting revenue, but DraftKings garners more headlines. The NYSE listing could give Flutter’s valuation a boost and allow it to close the gap. Flutter will retain its London Stock Exchange primary listing but delist from Euronext Dublin.

Disney’s streaming operating losses fell dramatically to $216 million as Disney+ shed 1.3 million subscribers last quarter. However, Disney still expects Disney+ to gain 5.5-6 million subscribers next quarter and profitability by 2024. Overall, streaming results were mixed – Hulu gained 1.2 million customers while ESPN+ lost 800,000. On the content front, Disney+ landed exclusive rights to a Taylor Swift tour film. Disney also continues pushing into gaming through a $1.5 billion investment in Epic Games, eyeing a separate Disney metaverse. Finally, higher pricing and advertising revenue boosted average monthly Disney+ and Hulu revenues per subscriber. But work remains towards achieving sustained streaming profitability.

Netflix is poised for strong growth in 2023, with earnings per share projected to surge 53.1% in the current quarter to $4.41. The streaming giant has topped earnings estimates in three of the last four quarters. For the full fiscal year, Netflix earnings are expected to climb 40.7% to $16.93 per share. Revenue growth is also robust – sales are estimated to hit $9.25 billion this quarter, up 13.4%, and $38.54 billion for the year, a 14.3% jump. The momentum should continue into 2024 as well, with earnings forecast to grow 21.8% to $20.63 per share next year on sales of $43.04 billion, up 11.7%. If Netflix meets these projections, it will cap several years of market-beating growth.

Morgan Stanley started coverage of sports and entertainment giant TKO Group Holdings (NYSE: TKO) with an Equalweight rating and set a $95 price target. The outlook considers TKO’s lucrative deals with major broadcasters like NBC and Netflix for premium live sports rights, which ensures strong cash flow conversion and contracted revenue growth. However, Morgan Stanley adopts a cautious view on sports rights inflation, expecting TKO’s core properties like UFC and WWE to see more modest growth during upcoming renewals. The $95 target represents ~22x 2026 price/free cash flow, indicating confidence in long-term profit drivers but also reflecting a prudently conservative take on near-term subscription revenue expansion. While TKO boasts strong margins and liquidity, 2024 guidance has faced recent downward revisions amidst timing uncertainties. The analysis sees TKO’s current valuation as fairly reflecting predictable growth levers but remains guarded on upside potential.

Roblox’s standout growth persisted in 2023, cementing its role as a vital social hangout for youth culture. Key metrics like daily active users, engagement rates, and monetization all notched fresh records. Importantly, users continue aging up, with now over half of the platform’s audience over 13 years old. This expands marketing options for brands seeking hard-to-reach Gen Z and young millennials. With strong momentum heading into 2024, Roblox looks set to sustain 20%+ user growth while launching improved advertising products and real-world commerce integration. Forward-thinking brands should leverage Roblox to drive awareness and sales among the next generation of buyers immersively socializing in virtual worlds.

Here’s the full index: