Manchester dis-united Club’s Ownership Saga: Ratcliffe’s Entry and Market Reactions

March 14, 2024

Carlo De Marchis ‘a guy with the yellow scarf pens down this month’s Business Index.

Manchester United, one of the world’s most iconic football clubs, has been the subject of intense speculation and market activity in recent months. The latest development in this ongoing saga is the official completion of Sir Jim Ratcliffe’s 25% buy-in at the club. The Ineos owner’s purchase, valued at just over £1bn, was announced on Christmas Eve and has now been formally confirmed.

Ratcliffe’s acquisition makes him the largest individual shareholder at Manchester United. The deal also includes a further investment of $300m (£238m) for infrastructure improvements at Old Trafford, which will earn Ratcliffe an additional 3% share later this year. The Premier League and the Football Association have both ratified the acquisition after Ratcliffe passed the necessary owners’ and directors’ tests.

Commenting on the deal, Ratcliffe stated, “To become co-owner of Manchester United is a great honour and comes with great responsibility. This marks the completion of the transaction, but just the beginning of our journey to take Manchester United back to the top of English, European and world football, with world-class facilities for our fans. Work to achieve those objectives will accelerate from today.”

Joel Glazer, United’s co-owner, welcomed Ratcliffe, saying, “I would like to welcome Sir Jim as co-owner and look forward to working closely with him and Ineos Sport to deliver a bright future for Manchester United.”

Market Reactions and Opinions

Despite the excitement surrounding Ratcliffe’s entry, the market’s reaction has been mixed. Sandy Case, iSportConnect CEO, notes, “The Glazers announce they are willing to entertain buyers and the share price doubles. Ineos steps in and the share price almost halves back to where it had been languishing for years.” Case also raises questions about the club’s complex structure, financial challenges, and the overwhelming nature of the task at hand.

On the other hand, Michael Broughton, another sport industry expert, offers a different perspective. “Buy the Gossip, Sell the News… an old adage in the market place,” he says. Broughton points out that the club is priced at a sponsorship/licensing valuation rather than a consumer or media valuation. He also highlights the impressive revenue growth achieved by the club’s management in the past, even without winning titles.

Broughton adds, “If you want to release valuation metrics you need to be more than a B2B company…not saying it’s easy, just the reality of things. There is value in having access to 1bn people. But until the fans come first it’s unlikely.”

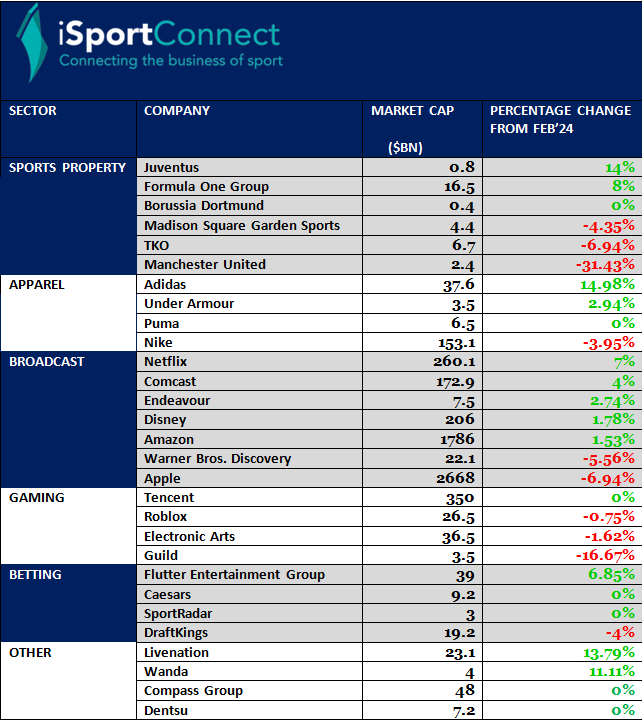

The Chart

Conclusion

The completion of Sir Jim Ratcliffe’s 25% buy-in at Manchester United marks a significant milestone in the club’s ownership saga. While the move has generated excitement among fans, the market’s reaction has been mixed. Questions remain about the club’s complex structure, financial challenges, and the scale of the task ahead.

Ratcliffe has also appointed an external agency to come in and streamline both the business and operational costs. The first area will be the club’s fixed and variable costs (travel, utilities and other external contracts) before looking at the 1,112 staff (as reported Jun 30th 2023) and there are already heavy rumours of 20-25% of these roles being at risk. The accepted view is that the staff numbers are bloated and need urgent attention. These are the first steps to allow the club more breathing room when it comes to Financial Fair Play and it will be interesting how Ratcliffe navigates this cost cutting with the retention of internal culture.

As Ratcliffe and his team begin their journey to restore Manchester United to the pinnacle of world football, the focus will be on addressing these challenges and putting the fans first. The road ahead may not be easy, but with the right strategies and investments, Manchester United could be poised for a new era of success both on and off the pitch. If they can manage to find a way to create more D2C revenue alongside the exIsting B2B revenue streams then the global fanbase that Manchester United have access to, could put Ratcliffe’s investment back into rude health.

Who are these people?

Sir Jim Ratcliffe:

Sir Jim Ratcliffe is a British billionaire businessman and the founder and CEO of the Ineos Group, a multinational chemical company. Born in 1952, Ratcliffe grew up in a working-class family in Manchester, England. He studied chemical engineering at the University of Birmingham and later earned an MBA from London Business School.

Ratcliffe’s career began at Esso and Courtaulds, before he founded Ineos in 1998. Under his leadership, Ineos has grown into one of the world’s largest chemical companies, with a portfolio spanning across various industries, including oil and gas, automotive, and sports.

Known for his entrepreneurial spirit and strategic investments, Ratcliffe has been actively involved in sports, particularly football and cycling. In 2019, he purchased the Team Sky cycling team, renaming it Team Ineos. His recent acquisition of a 25% stake in Manchester United marks a significant milestone in his investment portfolio.

The Glazers:

The Glazer family, led by the late Malcolm Glazer, is an American family known for their ownership of Manchester United Football Club and the Tampa Bay Buccaneers, an American football team in the NFL.

Malcolm Glazer, born in 1928 in Rochester, New York, was a successful businessman with investments in various industries, including real estate, energy, and sports. In 2005, Glazer acquired a controlling stake in Manchester United through a leveraged buyout, which was met with controversy and opposition from some fans due to the debt incurred during the purchase.

Since Malcolm Glazer’s death in 2014, his six children – Avram, Joel, Kevin, Bryan, Darcie, and Edward – have been involved in the management and ownership of both Manchester United and the Tampa Bay Buccaneers. Joel and Avram Glazer have been the most prominent figures in the family’s ownership of Manchester United, serving as co-chairmen of the club.

The Glazers’ ownership of Manchester United has been marked by success on the pitch, including numerous Premier League titles and Champions League victories. However, their tenure has also faced criticism from some fans who have questioned the club’s debt levels and transfer policies.

Here’s the full index: