Juventus Announces $200 Million Capital Increase Amid Financial Struggles

October 12, 2023

Red numbers everywhere this week and we turn our focus on the Juventus situation that is not looking pretty with their recent capital raise. Will this be enough? Carlo De Marchis, ‘a guy with a scarf’ pens down this month’s business index.

Italian football club Juventus announced plans for a €200 million ($195 million) capital increase as the team grapples with continued financial losses.

The capital raise, Juventus’ third in four years, was approved by the board of directors along with the company’s annual report showing a net loss of €123.7 million for the year ended June 30, 2023. Juventus said its shareholders’ equity was reduced to just €42.1 million as of June 30 and would be wiped out by additional losses expected in the first half of the current season.

The proposed capital increase will be put to a shareholder vote on November 23. Majority owner Exor, the holding company of the Agnelli family, has committed to subscribe to its 63.8% stake, amounting to €128 million. Including the upcoming capital raise, Exor will have injected €575 million into Juventus over the past four years as the club struggles financially. An incredible investment.

Juventus posted its sixth consecutive annual loss, albeit a smaller net loss of €123.7 million compared to €239.3 million the prior year. However, net financial debt more than doubled from €153 million to €339.9 million during the year. Revenue rose 15% to €507.7 million, aided by €70 million in profits from player sales. This is all extremely troubling.

The lack of Champions League revenue this season amid a disappointing start in Serie A play will continue to strain Juventus’ finances. The club said it expects to report a loss for the 2023-2024 fiscal year, but cost-cutting initiatives should yield improved operating performance.

Juventus’ share price has dropped nearly 40% over the past year amid the team’s on-field and financial struggles. The upcoming capital increase indicates significant dilution for existing shareholders as the club seeks to raise urgently needed funds.

In Other Stories:

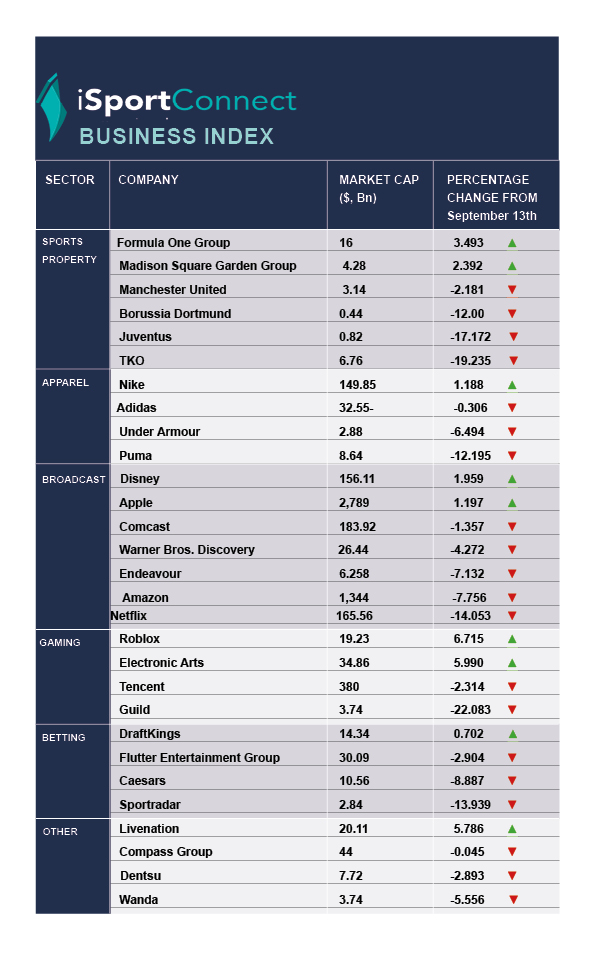

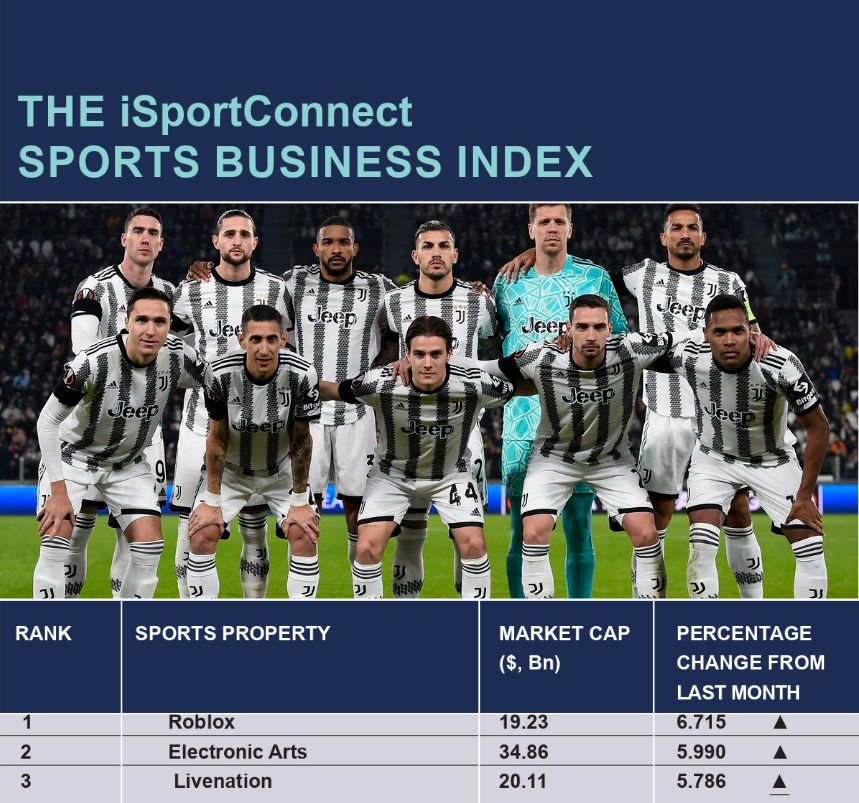

There is quite some red again in general across the index mirroring the global markets that are all down on the month with the honourable exception of the UK’s FTSE 100. The only positives could be found among the gaming sector.

Borussia Dortmund are also not doing well, and I could only track a very technical cash-flow related reason for that or perhaps the Juventus malaise is affecting other clubs too. I know there is a different ownership structure and business model but sectors can often move together

Formula One remains positive, maybe the Apple rumours have helped but this is a great example of a Sport property that has built an incredibly robust story and they are reaping the rewards .

Sportradar has taken quite a hit as well, at this stage I’m not sure exactly why but I spotted a story about a patent infringement from yesterday. I’ll keep an eye on this one

TKO is really not doing well after their recent IPO, could WWE cuts be a reason or is the merger not making sense in reality?

Here’s the full index: