Financial Services Dominate International Cricket Board Sponsors But It’s Not About The Affluent

October 19, 2023

With the ICC Men’s Cricket World Cup 2023 up and running, we decided it was time to take a deep dive into the companies sponsoring the leading international cricket boards through this month’s Sponsorship Index powered by caytoo.

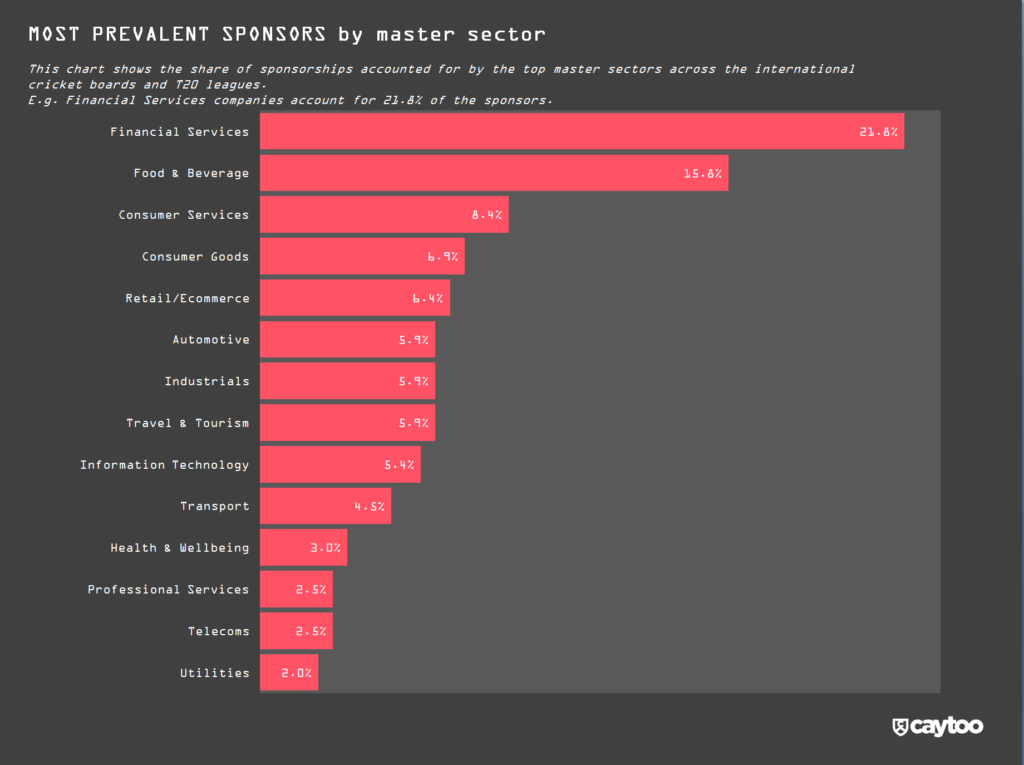

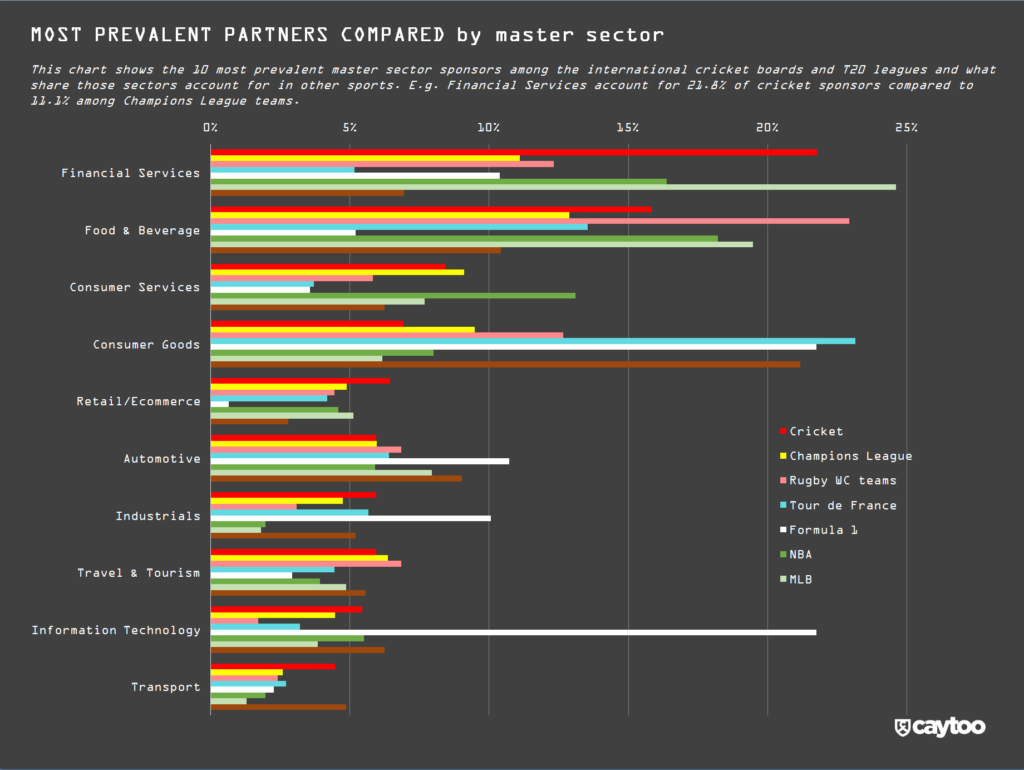

Financial Services accounts for 21.8% of sponsors, making the sector far more dominant in cricket than it is across other sports such as cycling’s Tour de France (5.2%), Formula 1 (10.4%), Champions League soccer teams (11.1%) and teams competing in the Rugby World Cup (12.3%). In fact, compared to sports federations around the world (6.9%), cricket boards are 3x more likely to have a Financial Services sponsor.

Only in US sports such as the NBA (16.4%) and the MLB (24.6%) do Financial Services have anywhere near the same share of voice.

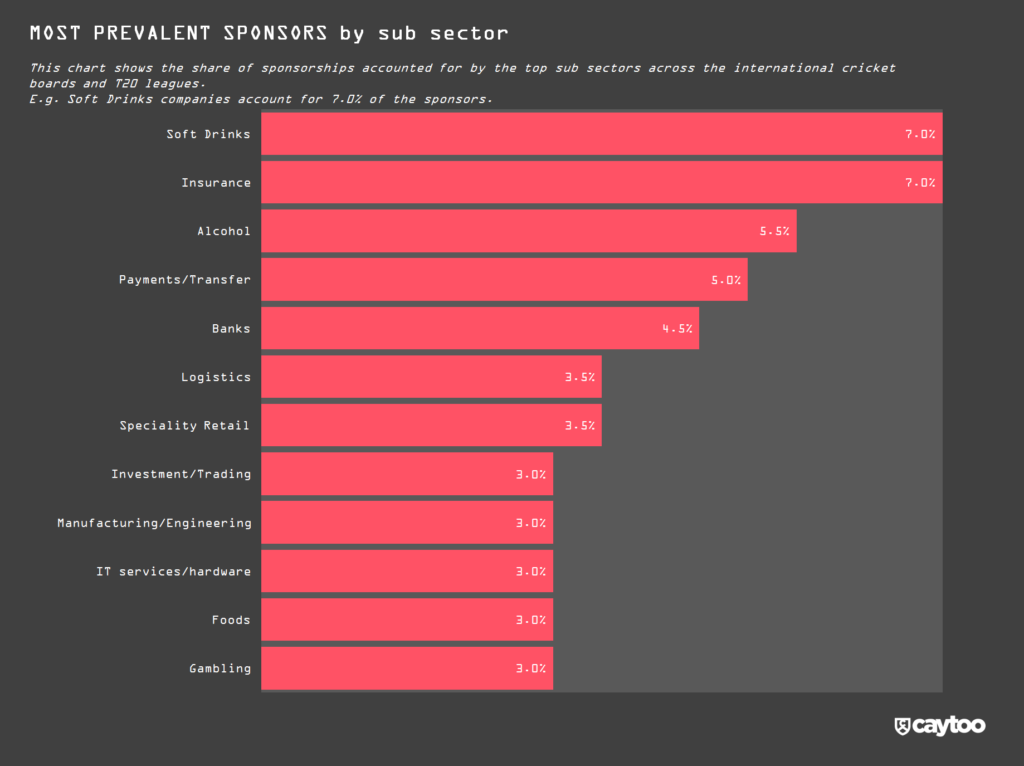

At first glance, this would tally with the general assumption that cricket fans tend to be more skewed towards the affluent demographic than other sports such as soccer and even rugby, hence Financial Services’ favouritism towards the sport. However, the reality is different: the sector’s dominance is driven by Insurance, Payments/Transfer and Banks, almost all of whom are targeting a mass market audience. For example, Metro Bank sponsoring the England & Wales Cricket Board, Commonwealth Bank doing so in Australia and ANZ bank in New Zealand.

This is driven by two factors.

Firstly, Asian subcontinent rights holders play a much bigger part in the analysis than all the other sports. In countries such as India, Pakistan, Sri Lanka, Bangladesh and Afghanistan – where affluent audiences also account for a much smaller share of the market – cricket is much more likely to be the national sport, thus, reaching a much broader demographic. The Asia factor, for example, is illustrated by the prevalence of money transfer-related sponsors, such as India’s RuPay and Paytm, an activity that Asian consumers tend to over-index on compared to ‘Western’ markets, particularly expats sending money to families back home. Indian money transfer app Abound, for instance, sponsors Major League Cricket in the US to reach Indian expats and the broader South Asian community in that country.

Secondly, this analysis – initiated by the global event of a World Cup – factors in most of the countries’ T20 leagues as these have the most global audiences of all the cricket formats due to the much higher prevalence of overseas players. T20 leagues are designed to bring cricket to a much wider audience than the more historic, longer formats of the game – one day matches and 5-day Test Matches – hence a more mass market fanbase that relevant brands are keen to reach. For instance, Visa sponsoring the West Indies T20 Caribbean Premier League.

Following Financial Services, Food & Beverage is the next most prevalent sector (15.8%) then Consumer Services (8.4%).

As with most of the other sports, F&B is driven by Soft Drinks (at 7.0%, the joint-top sub-sector alongside Insurance) and Alcohol (5.5%, third). Alcohol does well to feature so prominently given the lower drinking tendency in Asia, indeed only two alcohol brands from that region feature – Indian craft beer brand Bira and Nepalese vodka Ruslan.

The cricket boards also over-index on Consumer Services compared to sports such as Formula 1 (3.6%), the Tour de France (3.7%) and the Rugby World Cup teams (5.8%). The sector is driven by Gambling, QSR brand KFC – the most prevalent individual sponsor with four sponsorships – and fantasy sports game Dream11, the second most prevalent sponsor with three.

Alongside Financial Services and Consumer Services, cricket boards tend to over-index on Retail/Ecommerce and Transport sponsors (i.e. logistics and car rental brands) yet under-index on Consumer Goods, Health & Wellbeing and Professional Services.

The under-indexing on Consumer Goods is more a reflection of how the likes of Clothing/Apparel manufacturers see Champions League football teams and international rugby teams as particularly good channels to market and how Accessories and Home/Garden manufacturers see the Tour de France as the same. Electronics/Appliances also see Champions League clubs in this way as do Personal Goods brands for rugby.

Regarding Health & Wellbeing, this is likely due to sponsors seeing more physically vigorous sports such as football, rugby, cycling and basketball as a better vehicle to get their message across.

Professional Services is a surprise – given the game’s traditional link with corporate hospitality in the longer formats of the game – but again this will be due to the more mass-market consumer demographic offered by the T20 leagues being less relevant to B2B brands.

Let’s get into the Index: