Drive to Thrive: IT, Finance and Consumer Goods lead F1’s sponsorship growth

December 12, 2023

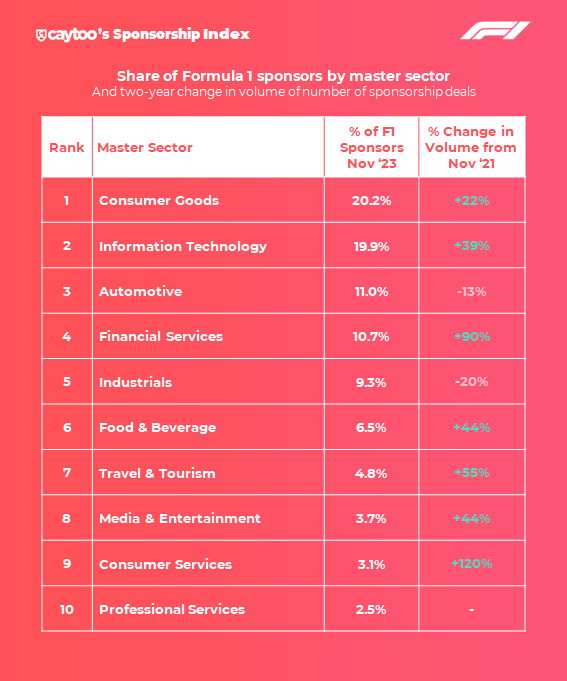

With the Formula 1 season having just finished and the teams no doubt taking stock of the sponsorship sales strategy ahead of the 2024 season, caytoo analysed the ~360 sponsors of the 10 teams and F1 itself to understand how the landscape has changed over the last two years in terms of the fastest-growing and declining sectors.

The number of F1 sponsors has jumped considerably in that time by 23% due to a combination of various factors. These include F1’s growing global fan base across TV, race attendees and social media, that audience becoming younger and more gender diverse, plus a near 10% increase in the number of races (factoring in the 2024 schedule). This growth has been particularly pronounced in the US through the extra number of races held in ‘glitzy’ locations – Las Vegas, Miami and Austin – which are heavily promoted and also create more global interest.

Over 75% of sponsor growth is being driven by just three sectors – Information Technology, Financial Services and Consumer Goods – and all of these can be attributable in some way to the sport’s younger audience.

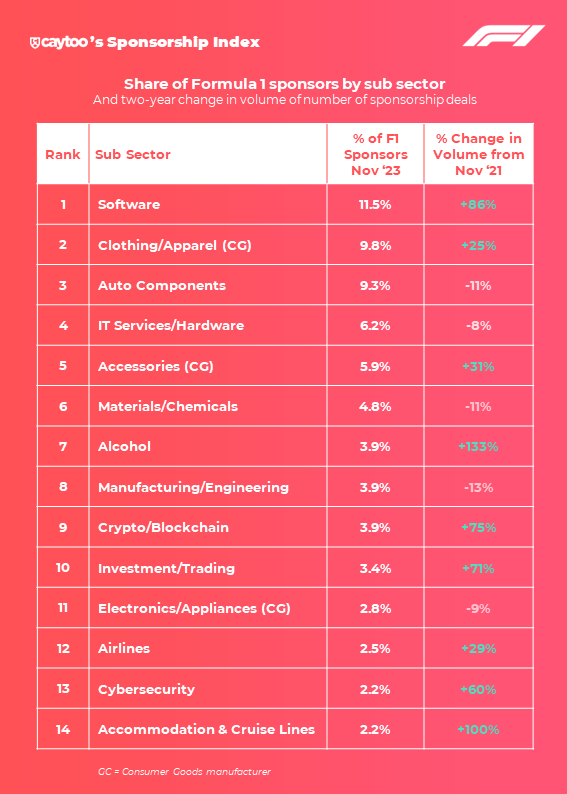

IT’s growth is dominated by Software brands; this sub sector seeing by far the biggest rise in the actual number of deals. F1’s emphasis around technology and innovation has always been a naturally strong fit with software and, although the sector itself doesn’t particularly target younger demographics from a purchasing perspective, many of the deals are centred around helping the teams to better engage with that fanbase, particularly on social, app and web channels.

For example, Salesforce x McLaren, with Salesforce stating the aim being: “to bring McLaren even closer to their fans across their digital platforms and deliver amazing digital experiences that help them connect with their global fanbase in a whole new way.”

Financial Services’ growth has been driven by the amount of Investment/Trading and Crypto/Blockchain sponsors rising by nearly 75%. Consequently, FS has overtaken Industrials as the fourth most prolific sponsor in F1. Many Investment/Trading sponsors are focused on online trading which targets a younger audience, such as Hantec Markets x Haas. This is the same for large crypto-related brands, such as Binance, OKX and OpenSea, increasingly jumping into F1 to generate awareness and, more crucially, trust and credibility on the global stage – particularly targeting Millennial and Gen Z audiences.

Consumer Goods remains the most common sector sponsoring F1 and its growth is mainly being driven by challenger brands to the traditionally dominant players in both Clothing/Apparel and Accessories. Clothing/Apparel includes the likes of newcomer shoe brands P448 x AlphaTauri and clothing brands such as K-Way x Alpine.

In turn, Accessories includes the like of upcoming glasses brands such as Web Eyewear x Alfa Romeo and luggage brands such as Globe Trotter x Aston Martin. Most are trying to reach a largely younger audience than the more traditional brands.

The fact that F1’s sponsor landscape is increasingly shifting towards younger audiences is reflected by Industrials and Automotive having the biggest drops in the number of sponsors. Industrials is primarily driven by a reduction in Construction sponsors while Automotive’s drop is mainly due to Auto Component brands. The latter in particular reinforces the sport moving away from its ‘petrol-head’-based roots to being positioned primarily as an entertainment brand, more in line with activations more typically seen in festivals and music.

You can find more about caytoo here.