New players vs traditional giants: what’s next for the sports media rights landscape?

October 26, 2017

Despite the changing and unprecedented media environment, the growth of sports media rights revenue is still robust.

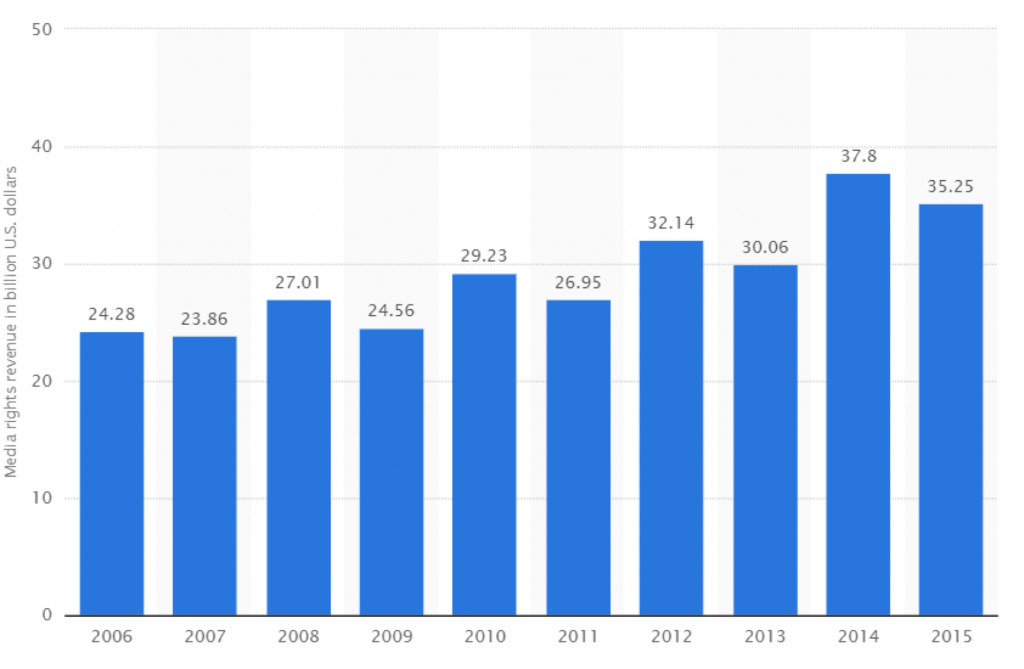

According to data statistics company Statista, from 2006 to 2015 sports media rights revenues have been constantly growing, with a peak of $37.8 billion (£28.5 billion) in 2014.

According to the 2016 sports rights report released by Sport Business Group, the market share of worldwide sports rights grew by 18% between 2014 and 2016, with a breakthrough of $43 billion (£32.5 billion) in 2016.

This analysis also suggests that the rights price of high-quality sports IP will be 40% to 80%. In terms of rights markets, America has the most share with $20.1 billion (£15 billion), accounting for 47% of the whole market.

The data shown indicates that the rights market will be still vigorous in the future. Thanks to new television deals – as well as the contribution of NFL and MLB – the United States’ sports rights market is expected to grow at a high speed in the future.

The previously released report of 2017-2020 by PwC shows that the value of the North American market will rise from $63.9 billion (48.2 billion) in 2015 to $75.7 billion (£57.2 billion) in 2020. The reason for the promising market lies in the rise of share in media rights and sponsorship, with a predicted growth speed of between 3.9% and 5.5%.

It is also predicted that the media rights revenue will grow to $21.3 billion in 2020.

From the perspective of the whole sports industry chain, media rights revenue with higher prices means that broadcasters need to pay more for high-quality sports events. If they get the rights at higher prices, they must recover the cost with the help of better operation ability.

However, not all sports events have a big enough fanbase to recover spiralling costs. Broadcasters and advertisers should be alert because while live sports consumption remains strong, its audience keeps ageing, and that’s troubling for advertisers.

That report described a few significant change of consumers, such as:

- Younger fans have an increased interest in short content, like stats and highlights.

- New availability of information has naturally funnelled some younger viewers away from TV.

- The WTA Tour is the only property to see its median age decrease during a 16-year span.

- The NBA has stayed fairly consistent, with the median age of viewers climbing only two years since 2000.

From these reports, we can come to the conclusion that broadcasters have to face a challenge of ageing viewership and the increasing cost of media rights. Indeed, the revolution of mobile internet has changed viewing habits and it has had the greatest impact on the industry.

According to a 2017 sport survey by PwC, there are three disruptors within the sports rights media market:

- The proliferation of new platforms (OTT, digital media, apps etc.) delivering content to fans.

- Expansion of mobile internet and ubiquitous access to sports content through mobile devices.

- Rights holders changing distribution strategy to establish direct relationships with fans (proprietary TV channel, social media following, etc.)

The rise of the smartphone as the device through which most of our daily activities are managed has resulted in people having a medium through which to consume content at all times, no matter our whereabouts.

We now have (at least) one generation of consumers that has grown up with mobile devices with high-speed internet connections at hand, a phenomenon that has inevitably and irreversibly moved their consumption habits away from linear programming and towards on-demand content.

Furthermore, the global ubiquity of alternative on-demand content means that (live) sport is now competing with various other entertainment formats far more than it used to. OTT solutions such as Netflix or HBO are investing more than ever in the content they produce (or acquire the rights for), attracting subscribers with a multitude of engaging series, films, shows and documentaries to choose from. These become the number one development disrupting factors of the sports rights media market.

Therefore, sport is now competing with other entertainment formats far more than it used to, fans have changed their habits and consumers are moving away from television to watch the events on other devices.

There is no doubt that the emerging technology has advantages in the new era. As the sports rights market continues to expand, they still have opportunities to cut into the market.

The new players’ layout

Sports events have attracted enterprises which excel at digital distribution on account of their need to draw sports fans among younger users.

Due to the evolution of broadcast technology and changes in consumers’ viewing habits, mobile internet and online broadcast are becoming the preference of more and more younger sports fans, especially in North America, where the communication technology and sports market are more developed.

Faced with the new trend, major leagues are gradually adapting themselves to the new era.

The current commissioner of the NBA, Adam Silver, is one of the league heads that is positive about innovations. Since coming into office, Silver has put emphasis on the innovations in line with the technology development and the changing viewers’ tastes.

In an interview in early 2017, he expressed his intention to adjust the payment plan and the possibility of introducing pay extracts from the last few minutes of the games. Moreover, in mid-September, Silver also mentioned the great changes that might happen to the mediums of live sports in the next few years, and the influence companies like Twitter, Facebook and Amazon have on live sports.

These facts not only reveal the increasing attention the leagues paid to the new trend but also imply that they are open to more possibilities.

Given all these, Twitter, Facebook and Amazon will be taken as examples to demonstrate how emerging enterprises like social networking companies and Internet-based retailers entered the sports broadcast rights market.

As a social platform, Twitter is trying to expand its business, including photo and video content.

Twitter has always been an important channel for fans to follow superstars and teams. However, Twitter has not made any big move in terms of co-operation with certain leagues or associations. In 2012, Twitter bought Vine, a video clip sharing app, and soon after this purchase it ushered in a service called Twitter Amplify to allow IP holders to send short videos along with their tweets.

The service aroused the interests of leagues and also advertisers. After Twitter Amplify, Twitter put its focus onto live broadcasting.

In other words, live broadcasting and video clips will always be the core of the sports industry. The combination of video clips, live broadcasting and social platforms will make sports and athletes more influential. Moreover, it will create more possibilities for Twitter and advertisers to develop business co-operation.

In addition, Twitter has also partnered with the UFC, NLL and other competitions. The main purpose of Twitter’s layout on streaming live (not only sports) is to attract users and increase revenue.

According to Twitter’s financial report of 2017 Q1, Twitter added nine million users in the quarter, which is the fastest growth since 2015 Q1. At the same time, Twitter’s MAU (Monthly Active Users) also increased by 14% (the specific numbers were not released). Twitter said these increases are largely related to the increase of live streaming content.

While this trend didn’t hold up in the Q2, Twitter still believes live streaming can bring major benefits.

Twitter’s COO Anthony Noto also confirmed that the company plans to increase its live streaming, reaching 1,200 hours stream on Twitter in a single quarter.

These partnerships will certainly bring considerable revenue to Twitter. According to the report of Market Realist, Twitter received no less than an $8 million (£6 million) promotion fee from NFL in the 2016 season. With the extension of the co-operation, Twitter will definitely acquire more relevant income.

Another social media company who has a keen interest in sports is Facebook. In this year only, Facebook has reached several agreements with many tournaments.

In January 2016, Facebook launched a live sports platform called ‘FacebookSports Stadium’. The service aimed to be a real-time broadcasting platform which also allowed the fans to share their comments and opinions.

The reason why Facebook launched such a service is the huge market potential of the sports fans, who have brought huge advantages to the popular platform. During the 2014 World Cup, a total of 350 million people posted their opinions on Facebook, while brands such as Budweiser have also been marketing on Facebook. Of course, with good results.

In addition to attracting users and increasing advertising revenue, sports streams was also a necessary move for Facebook to develop its video content.

In August 2017, Facebook launched a new video service called Watch. The service is set to provide various video content, including series, live broadcast and other sporting events. Facebook offers the Watch service on its mobile apps, websites and TV apps.

Watch is the latest product of Facebook’s video production line, which will compete with traditional video content companies such as Netflix and YouTube.

Jerry Newman, Facebook’s sport partnership lead in Europe, Middle East and Africa, has explained the organisation’s present strategy and the intentions of Watch: “The episodic approach to Watch is really important.

“If you open your ‘News Feed’ you know what you get, the algorithm is going to search and you’re going to get specific content. But, with Watch you’re going to subscribe to a number of pieces of content and that’s going to pull you in.”

Amazon’s plan has some differences. The e-commerce giant wants to improve its business lines by enriching content such as sports and entertainment.

“Their goal is to become a multi-system operator in this new era,” said Ken Solomon, CEO of the American Tennis Channel.

What is noteworthy is that many of Amazon’s live broadcasts are aimed at users of Amazon Prime, the high-quality membership services of Amazon. According to some related reports, Amazon Prime’s membership has grown from 55 million (2015) to more than 80 million.

Though the number of users has grown steadily, the number of active users has not expanded. And that is also one of the reasons why Amazon began to try sports live broadcast: they want to attract younger consumers and generate more advertising revenue.

After gaining some operational experience, Amazon has also opened similar video content services to regular users. Predictably, digital video content will not only be a tool to increase membership but also a test bed for future business growth points. Just as Facebook has launched its Watch service, Amazon has its own plan to compete with Netflix and the other video companies.

The former executive of Sports Illustrated, James Lorenzo, recently joined Amazon to take charge of the sports business department. Charlie Neiman, a former YouTube executive, also joined the group, to lead sports business development. These personnel adjustment show that Amazon are attaching much more importance to sports content.

Amazon have also beaten Twitter (TNF’s steam rights) and Sky Sports (exclusive rights of ATP tournament in UK) in bidding. Theses ‘victories’ show that Amazon have a further plan about the media right of sports events.

Taken together, the advertisement revenue gained from sports content distribution is more attractive for those three companies – and the data shows that advertisers are increasing their budgets on the online platforms.

According to PwC’s global entertainment and media outlook for 2017-2021, global internet advertising surpassed global TV advertising in 2015, with mobile online advertising set to overtake wired online advertising in late 2018.

This expectation is coming true in United States. According to a report from IAB, in 2016, the online advertising revenue grew by 22% year-by-year and had a record-high revenue of $725 million (£548 million). For the first time, the online advertisement revenue had surpassed TV advertisement.

Compared to traditional broadcasters, advertisers will be inclined to co-operate with new tech players with all those online data analytics. For instance, Amazon is able to analyze its THF audiences by tracking their preferences and behaviors. And it will be hard for advertisers to resist increasing their budgets on Amazon.

Therefore, PwC suggested that the online advertisement investment will bring a higher rate of return, considering the combination of media convergence and development of data.

And that’s why in the United States more and more tech companies are involved in the sports industry.

Fresh Off the Boat

While these new players are gearing up for the sports industry, they still have a long way to go in terms of broadcast. As we can see, these three companies are more interested in purchasing content rights (as highlights or video clips). While for live broadcast rights, both parties – the IP holders and the IP buyers – remain cautious.

For example, the NFL has agreed broadcast rights deals with both Twitter and Amazon. These two deals holds hardly any weight against the deals that the NFL has in place with traditional broadcasters.

Meanwhile, MLB and NHL have only licensed a few matches to their new media partners. Although NBA and Twitter are deepening their co-operation, Twitter users still have no access of watching live games through Twitter. While Facebook has made a single live game available to users in India only.

Indeed, new players are now facing some difficulties with IP rights.

However, tech companies want more. Amazon has already made a move as they bid directly against Sky Sports and took the exclusive broadcasting rights of ATP in British. Moreover, reports have said that Amazon and Facebook might join the bidding for the Premier League broadcasting rights in the new season. And who will be their rivals? BT and Sky Sports.

PwC has also drawn a conclusion suggesting that tech companies are trying to play more important roles on IP rights markets. However, nobody knows when the tipping points will come. But, regardless, tech companies have lots of work to do.

First of all, for companies as Amazon and Twitter, broadcasting sports will be a kind of crossover. Crossover is not easy. Comparing the highlights and video clips they have now, broadcasts need more work including programming planning and producing. The gaps are quite big between tech companies and traditional broadcasters. Even in terms of livestreaming, tech companies are not old hands.

However, tech companies will have plenty of chances as people changes their habits as we can see from a case study on THF broadcasting presented by Amazon on September. According to the NFL, an audience of more than two million watched the live broadcast through Amazon’s platform.

Twitter reached an audience of 2.3 million for the opening match last year, but Amazon users had a longer average viewing time. According to the NFL, the number of people watching at least 30 seconds went up to 372,000, compared with 243,000 on Twitter last year. The data is showing that the consumer perception is growing.

Secondly, traditional broadcasters are facing the challenges from live streaming technology. Therefore, they are adjusting themselves. And is also influences tech companies since live streaming platforms are what they rely on. As a report mentioned recently, ESPN is planning on creating an online platform service for sports.

And Sky is evolving their service and launching an APP for its online service. Traditional broadcasters are taking measures to encounter challenges. Moreover, traditional broadcasters usually have a longer contract length and tech companies are likely to have to wait for current rights deals to expire.

Thirdly, lots of leagues and associations are providing their own OTT services. For instance we have seen the introduction of NBA League Pass, NHL Gamecenter and iFollow, while MLB even established their own livestreaming company BANTech. This will be another big challenge for those newcomers.

IP markets are expanding. The development of technology is bringing new players to the table. Therefore, If Amazon spends an enormous amount of money to buy certain IP rights, we shouldn’t feel shocked.

According to a Bloomberg report, the NFL is trying to maintain an ambiguous relationship with all the ‘big three’ tech companies. When their current broadcast contract expires in 2021, the tech companies will have a chance to bid for the new contract. Tech companies have huge advantages in regards to end-users, technology support and high market capitalisation.

A campaign between new players and old giants is expected to take place, which might just become the norm.

Lanxiong Sports is the first sports business content provider in China and has become the first multi-service platform of the industry. Click here to see what we are doing.