Prof Dr Uğur Erdener, the President of World Archery, has been appointed unanimously by the Executive Committee as the new President of SportAccord, the global sports event organisation that is governed by stakeholders representing Olympic and non-Olympic International Federations (IFs).

Prof Dr Uğur Erdener has served as President of World Archery since 2005 and has been an IOC Member since 2008. A widely-respected physician, President Erdener is the Chair of the IOC Medical and Scientific Commission and is also a member of the WADA Executive Committee, a member of the board of the ITA and Vice President of ASOIF. Since 2011, he has been President of the National Olympic Committee of Türkiye.

Erdener, who will serve a four-year term as SportAccord President, will be supported by his seven colleagues on the new SportAccord Executive Committee, the composition of which was confirmed during yesterday’s General Assembly (in alphabetical order by organisation):

Ingmar De Vos (BEL) – ASOIF representative

President, International Equestrian Federation (FEI)

Uğur Erdener (TUR) – ASOIF representative

President, World Archery (WA)

Petra Sörling (SWE) – ASOIF representative

President, International Table Tennis Federation (ITTF)

Einars Fogelis (LAT) – AIOWF representative

President, International Luge Federation (FIL)

Beau Welling (USA) – AIOWF representative

President, World Curling Federation (WCF)

Anna Arzhanova (RUS – SER) – ARISF representative

President, World Underwater Federation (CMAS)

Riccardo Fraccari (ITA) – ARISF representative

President, World Baseball Softball Confederation (WBSC)

Stefan Fox (GER) – AIMS Representative

Secretary General, International Federation of Muaythai Associations (IFMA)

General Assembly also ratified new statutes under which SportAccord will operate according to a revised governance structure whereby all of the IF umbrella bodies will be represented, as reflected in the new composition of the Executive Committee above. The new statutes also bring the association into line with best practice corporate governance, clearly defining roles and responsibilities between the Executive Committee, the General Assembly and the Secretariat.

New SportAccord President Prof Dr Uğur Erdener said: “I am gratefull for the confidence of my colleagues and I am looking forward to serve SportAccord as President over the next four years. I am grateful to my friend Ivo Ferriani for all the work he has done in transforming SportAccord over the last two years and also for the work accomplished by his Executive Commitee colleagues Ingmar De Vos, Francesco Ricci Bitti and Luc Tardif.”

Erdener succeeds International Bobsleigh and Skeleton Federation (IBSF) and AIOWF President Ivo Ferriani at the helm of SportAccord, who said: “As my term comes to an end, it is with spirit of service and a mission accomplished that I hand over the baton to Uğur Erdener. I offer my successor the very best wishes in building, starting from this solid base, a prosperous future for SportAccord and sport as a whole.”

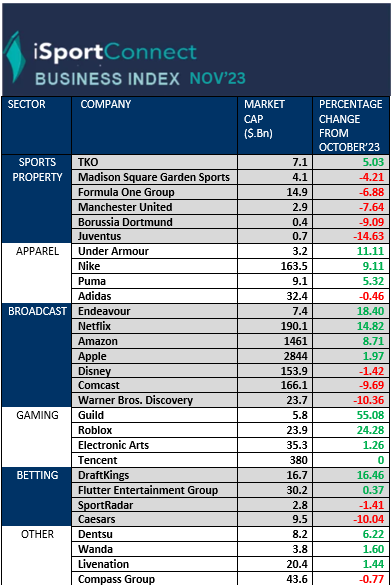

SportAccord is currently hosting the IF Forum 2023, which takes place from 13 to 15 November at the Olympic Museum in Lausanne and gathers hundreds of leaders, experts and decision-makers from across the global sports movement. Under the theme of ‘Sport (R)evolution’ the IF Forum covers topics including the use of new technology to build fan engagement and optimise the monetisation of IF assets, the strategies that have succeeded in revolutionising women’s sport, climate action and other topics that are transforming the environment in which IFs work.

Also attending the IF Forum is a delegation from the host of SportAccord’s next major event, the World Sport & Business Summit, to be held from 7 to 11 April 2024 in Birmingham and the West Midlands, UK.