The View From The USA: What drives the price of an NBA franchise

May 11, 2023

In this View From article, Kurt Badenhausen Sportico’s Sports Valuations Reporter, looks into the sale of the Phoenix Suns and explains why a middling NBA franchise is so expensive.

There are an unprecedented number of trophy sports assets on the market right now. Buyers have their choice of the Premier League’s two most valuable clubs, a storied NFL franchise, big market baseball teams on either coast and an NHL team in hockey-mad Canada.

The Phoenix Suns sale to mortgage-mogul Matt Ishbia was finalised on February 9, on the same day the Suns traded for NBA All-Star and former MVP Kevin Durant.

Ishbia’s purchase of a controlling interest in the Suns and the WNBA’s Mercury eventually went through at a valuation of $4 billion, a record for an NBA franchise.

But what makes an NBA with middling revenue, with no Title and only two Finals appearances since 1993 so attractive for investors.

Phoenix is a fast-growing metro and an attractive market for NBA free agents and billionaires alike, thanks to the Arizona climate in winter, but the chance to secure a franchise within the top half of the hottest sports league is why so many investors were kicking the tires on the Phoenix Suns.

Back in November Sportico valued the Suns at $3 billion, and it ranked 13th in our third annual NBA team valuations. But the Suns will likely sell for a higher revenue multiple—the standard valuation used for sports teams—than Manchester United, Liverpool, Washington Commanders, Washington Nationals, Los Angeles Angels or the Ottawa Senators.

Sportico spoke to more than 35 people involved in the business of basketball over the past month, including eight bankers and attorneys involved in team transactions. Most are bullish on the league’s prospects, relative to other sports properties. The average NBA franchise is worth $3 billion, up 16% versus last year. It is a strong showing, considering the S&P 500 is down 16% during the same period. Collectively, the NBA’s 30 teams are worth $90 billion, including team-related businesses and real estate held by owners.

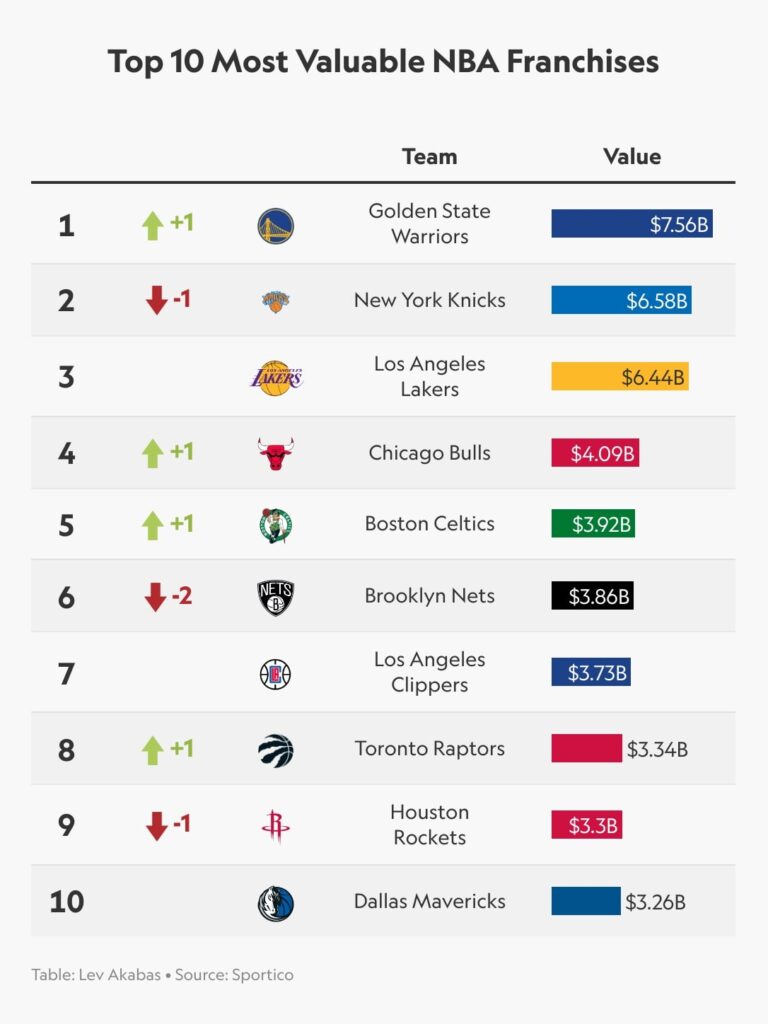

The average is boosted by a top-heavy distribution of team values, with the Golden State Warriors ($7.56 billion), New York Knicks ($6.58 billion) and Los Angeles Lakers ($6.44 billion) all worth at least $2 billion more than fourth-ranked Chicago Bulls ($4.09 billion). The median NBA franchise is worth $2.38 billion.

Golden Dynasty

Golden State has built the model NBA franchise on the court, with six NBA Finals appearances and four titles during the past eight seasons behind Stephen Curry, Klay Thompson and Draymond Green. The Warriors’ status might be even better off the court. Last season marked the team’s first year in the Chase Center without COVID-19 restrictions and limitations. Gross revenue topped $800 million, including non-NBA events, and was an estimated $750 million after revenue sharing, 50% higher than the Lakers.

In addition to winning its fourth title in the current era, the Warriors ranked first by almost every measure last season—by a wide margin—including sponsorships ($150 million), premium seating ($250 million) and local TV ratings (6.98), which were all roughly double the second-ranked team in each category.

The Warriors passed the Knicks this year as the NBA’s most valuable team and trail only the Jerry Jones-owned Dallas Cowboys— worth $7.64 billion—among all sports teams. The New York Yankees are third at $7 billion, with the Knicks and Lakers rounding out the top five.

Joe Lacob, Peter Guber and their investment group paid $450 million for the Warriors in 2010. Lacob sees Disney as a model for diversifying the team’s business approach and isn’t satisfied with ranking second in anything. “Jerry has done a great job with the business of the Cowboys, but we are going to chase him down too,” Lacob said in a phone interview.

Phoenix Rising

In September, Robert Sarver announced he would sell the Suns and the WNBA’s Mercury following an investigation into accusations that he created and oversaw a racist and misogynistic workplace. The NBA suspended Sarver for one year and fined him $10 million.

Last season, the Suns generated an estimated $300 million in revenue and $70 million in earnings before interest, taxes, depreciation and amortisation. There have been multiple initial bids submitted to Moelis & Co., the investment bank Sarver hired to handle the sales process, and there is a strong possibility the team will command 10 times its 2021-22 revenue. The team’s valuation includes the Mercury and Suns’ practice facility.

The buyer pool extends well beyond Arizona, as Phoenix checks a key box for southern California billionaires who can catch a game at Footprint Center and still sleep at home after a one-hour hop in their private jets.

Last month, the NBA gave Suns bidders another funding source when it voted to allow investments from endowment, pension and sovereign wealth funds, as first reported by Sportico. In 2020, the NBA became the first major U.S. sports league to approve private equity investments. The framework allows a fund to purchase up to 20% in one team and allows franchises to have up to 30% of its total equity held by funds. The new groups of institutional money are expected to be granted a similar framework.

“It expands the investor base and opens the door for opportunities for us in the future,” Dallas Mavericks owner Mark Cuban said in an email. The top five university endowments hold $193 billion in assets, led by Harvard at $51 billion. CalPERS, which manages pension benefits for 1.5 million California public employees, had $442 billion in assets at the end of last year.

“The move puts more liquidity into the market, and these funds can write really big checks,” Sal Galatioto, longtime sports investment banker, said in a phone interview. “Sports teams offer some diversification, and these assets are not really correlated to the stock market.”

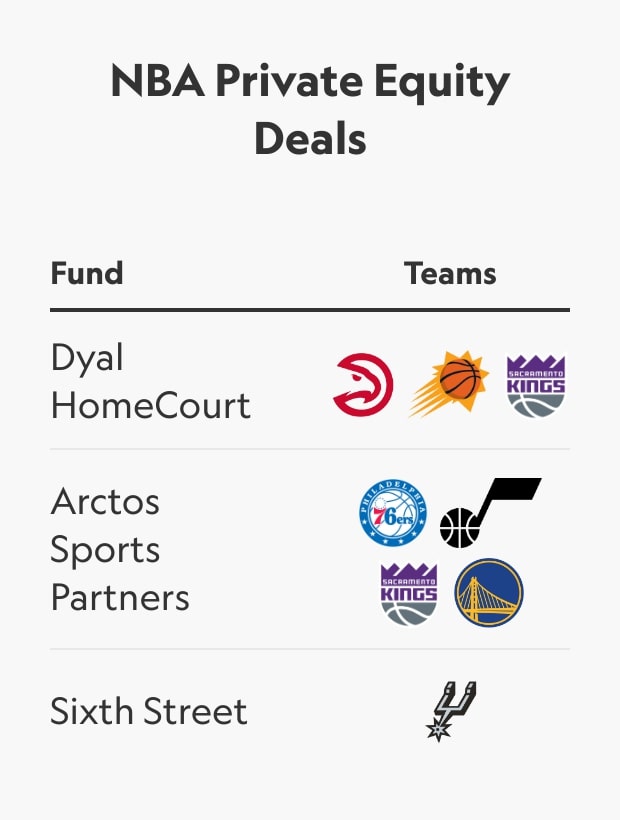

Private equity firms have invested in at least seven NBA teams since the start of 2021. Dyal HomeCourt bought stakes in the Atlanta Hawks, Suns and Sacramento Kings. Arctos Sports Partners’ portfolio includes the Warriors, Philadelphia 76ers, Kings and Utah Jazz. Sixth Street bought a 20% piece of the San Antonio Spurs. These funds are doing so strictly for a return on investment, and not some of the intangible perks that sometimes draw in limited partners.

The NBA’s new rules allow these other entities to invest directly into teams and avoid the fees associated with the Dyal and Arctos funds, but those funds will still play a role. They allow investors to have exposure to multiple teams, and also allow investment without the public scrutiny and deeper background check that comes with direct stakes as a team owner.

Dyal is poised to cash in on its Suns investment, which came at an LP-discounted $1.55 billion valuation during the first half of 2021. It’s believed the firm is the only Suns investor with “tag-along” rights, meaning anyone buying Sarver’s 35% stake would also need to buy out Dyal’s 5%. Sarver led an investor group that paid $401 million for the Suns in 2004.

Next Frontier

After two COVID-19 impacted seasons, business returned largely to normal and NBA teams generated $10.1 billion in revenue in 2021-22, including non-NBA events at arenas where owners own or control the venues. That compares to $6.5 billion for the 2020-21 season when attendance was off significantly because of capacity restrictions. The Raptors were the one team that continued to feel the COVID hangover; lingering rules forced the team to play a dozen games in early 2022 with no fans in attendance at Scotiabank Arena.

Teams are reaping the benefits of new revenue streams from gambling, jersey patches, and international sponsorships. The top three jersey sponsorships generate $100 million annually, led by the Warriors’ extension with Rakuten worth an estimated $45 million a year. The Brooklyn Nets (WeBull, $30 million) and Lakers (Bibigo, $27 million) are the next largest pacts. “We’re a respected brand here, but also internationally, and that’s a huge opportunity that we are just scratching the surface of,” Warriors’ president Brandon Schneider said in a phone interview.

The NBA’s outlook and flexible ownership rules have attracted bidders for the Suns but also has investors thinking about expansion franchises. LeBron James has voiced his interest in a team in Las Vegas, and Seattle is a near lock for expansion. “At some point, this league will invariably expand, just not at this moment,” Adam Silver, NBA commissioner, said during his 2022 NBA Finals press conference. The last expansion franchise was Charlotte, which started play in 2004 and cost $300 million.

The league has more pressing issues before it turns to expansion. The collective bargaining agreement expires after the 2023-24 season and both sides have an opt-out to end it after the current season—the Dec. 15 deadline for the opt-out was recently extended, giving the two parties more time to negotiate. There is cautious optimism that a deal will come together, with both franchise values and player salaries soaring. Once the CBA is done, league executives will need to lock in their next round of national TV deals, which are set to expire after the 2024-25 season. Any new pact probably won’t be reached until 2024.

Once those two pillars are in place, the NBA will turn its attention to expansion, but it will take multiple years to identify the right owners, cities, venues and get the franchises up and running, meaning it will likely be near the end of the decade before any new teams take the court. The math on an expansion fee becomes easier after the CBA and TV pacts are reached, and a couple of franchise sale prices that start with a three, or even a four makes a difference. Some owners won’t want to dilute their shared revenue or equity stakes in league properties, such as NBA Equity, NBA China and NBA Africa, but divvying up $8 billion in potential expansion fees will make that an easier pill to swallow.

TV Picture

The choppy RSN market has NBA teams covering their bases for an uncertain broadcasting future as consumers ditch cable. This season, the Clippers became the first team to offer local fans a series of options to watch games without a cable subscription. ClipperVision provides six different streams, including two non-English ones. “I have wanted to create a product like ClipperVision since the day I came to the Clippers,” Steve Ballmer, who bought the Clippers in 2014, said in a statement around the launch.

“We are progressing in the design and development of our direct-to-consumer offering and remain on track to launch in the second half of the current NBA and NHL seasons,” Andrea Greenberg, MSG Networks CEO, said on her company’s earnings call last month. “So while the media landscape is certainly evolving, we continue to believe in the value of our premium content and our ability to innovate, to drive value for partners, advertisers and viewers alike.”

In August, Ted Leonsis’ Monumental Sports & Entertainment, which includes the Washington Wizards, bought the 67% of NBC Sports Washington from Comcast that it did not already own. MSE already had its own streaming platform, Monumental Sports Network, that airs the WNBA’s Washington Mystics, and this provides more options. “It’s not unlike someone who owns teams and owns a building,” Ed Desser, who spent 23 years in the league office and helped launch NBA TV, said in a phone interview. “It’s a key asset, and you can package it and leverage it more when you have more control than you could as a pure tenant.”

The distribution options for NBA games will evolve over the next decade, but the content remains valuable with a young fan base that covers every corner of the globe. And any haircuts that teams might take in the short-term on the local level are expected to be offset by the next national deal.

The current TV deal is worth $2.7 billion annually and the next rights are expected to at least double that figure, assuming the NBA carves out a streaming service package. Moelis is highlighting this new financial picture in its Suns’ pitch, projecting a world where the team’s revenue is north of $400 million.

Warner Bros. Discovery CEO David Zaslav recently said at an investor conference that WBD does not “have to have” the NBA, as the company deals with a sluggish ad market and rising content costs. The NBA has been a cornerstone of TNT’s programming for three decades, and Zaslav’s comments were widely seen as posturing in a negotiation for the only major sports rights available over the next five years.“There’s not a major sports media company out there that is not going to want a relationship with the NBA if it becomes available,” media consultant Lee Berke said.

About the Author: Kurt Badenhausen is a sports valuations reporter at Sportico. Prior to joining, Sportico he was a senior editor at Forbes where he worked from 1998 to 2021. He co-engineered Forbes’ annual sports team valuations and launched numerous initiatives at the company, including annual features on brand valuations, best banks and top business schools. He profiled a bunch of athletes who go by one name: LeBron, Shaq, Danica and others for the magazine. Prior to joining Forbes, Badenhausen worked at Financial World magazine where his coverage focused on investing, mutual funds and the business of sports. He graduated from Colgate University with a degree in history and resides in New Jersey with his wife, two sons and black lab.