“NFTs Possess Qualities That Make Them A Brand New Asset Class That We Think Will Dominate The Digital World”

May 18, 2021

Pedro Febrero, Head of Blockchain at RealFevr, provides some special insight into the world of blockchain and NFTs, the hottest topic in sport at this current time.

NFTs stands for non-fungible crypto tokens that represent a unique digital item. Such as an image, video, motion graphic, some artwork, music, etc.

They are managed on a blockchain, which traces the ownership and transaction history of each NFT, providing it with a unique code ID and metadata that no other token or user can duplicate. They are also impossible to counterfeit and immediately authenticated.

Imagine that each Bitcoin could possess different properties from one another. Or that Ethereum tokens could be endowed with unique properties that distinguish them from one of their peers.

That’s precisely what NFTs are. A digital collectable that can attribute specific properties to each of the tokens that compose a token set.

“NFTs possess qualities that make them a brand new asset class that we think will dominate the digital world.”

However, NFTs have been mostly restricted to newborn games and aesthetic collectables.

RealFevr is about to change that for good.

In this article, we’ll describe what NFTs are and how they’ve evolved since they were conceived; we’ll dive deep into the booming NFT space and look into some critical statistics and predict what type of applications will emerge that will boost the adoption of NFTs. Finally, we’ll explain what RealFevr NFTs are, how they work and why they’re the first digital collectable that not only possesses unique aesthetic properties, but can also be used in a broader ecosystem, outside the blockchain-space.

RealFevr will be the first organization to connect and power-up an off-chain fantasy football game with on-chain NFTs and to build a digital marketplace for NFT owners to lend their assets in return for a yield.

The Early Days of NFTs

NFTs exist in the realm of digital collectables. As you’ll soon learn, they are unique digital assets that contain attributes that make them distinct from their peers. However, this idea was born a few years back, and was conceptualized by a key player in the cryptography and cryptocurrency space.

In “Shelling Out: The Origins of Money”, Nick Szabo describes the power of collectables as money-transfer mechanisms. He wrote: “Indeed, collectables provided a fundamental improvement to the workings of reciprocal altruism, allowing humans to cooperate in ways unavailable to other species.”

Essentially, Szabo highlights the importance of collectables in society, not only as a means to exchange value, but because collectables represent a common goal with shared values by a group of individuals – a community.

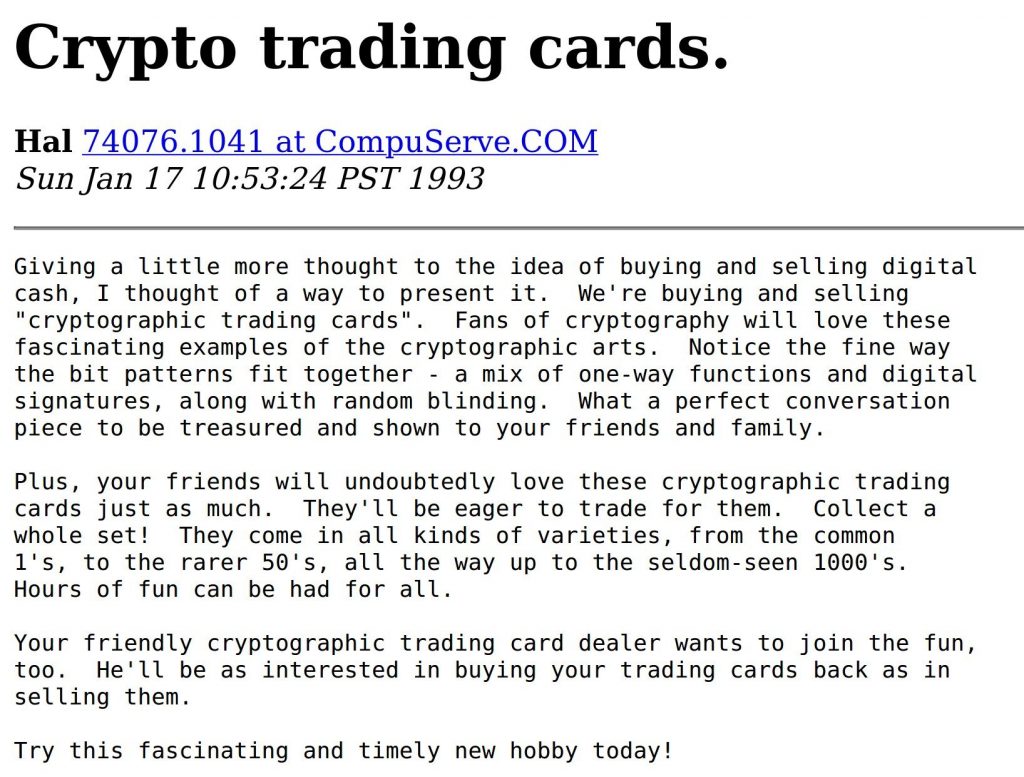

The late Hal Finney also understood this concept and brought it to the digital realm.

“Collectables are becoming the leading trend in the cryptocurrency space.”

Finney wrote in 1993: “We’re buying and selling ‘cryptographic trading cards’. Fans of cryptography will love these fascinating examples of cryptographic arts.”

The cryptographer absolutely nailed it. Collectables are becoming the leading trend in the cryptocurrency space, and we think that when combined with the power of DeFi, or Decentralized Finance, NFTs will become a digital commodity accepted and traded by the majority of cryptocurrency enthusiasts.

Properties of NFTs

A non-fungible token (NFT) is a type of cryptographic token on a blockchain representing a single asset. These can be entirely digital assets or tokenized versions of real-world assets. Since NFTs are not interchangeable, they can function as proof of authenticity and ownership within the digital realm.

NFTs possess qualities that make them a brand new asset class that we think will dominate the digital world shortly. NFTs critical properties are:

- Uniqueness – These assets have many analogies with works of art, of which there may be copies (it is even easier to make copies of digital works), but here the owner can certify that he is the sole and actual owner of the original work, although it can be easily shared on the internet (and it is). It’s a curious situation and a shift in the value we place on physical and digital works of art.

- Non-interoperable: one NFT may possess different attributes than one of its collection counterparts. Hence, they’re not interoperable.

- Indivisible: Unlike cryptocurrencies, NFTs cannot be divided into smaller pieces, and they have a total value as a whole entity or token without more. You can’t have 1/1000 of a crypto kitty.

- Indestructible: the data of an NFT is stored in the blockchain through a smart contract (Smart Contract), which makes it impossible to destroy, delete or replicate.

- Absolute ownership: unlike music or movies, your property is yours if you buy one of these goods. You do not buy a license to see the movie or listen to the song, but that intangible good is entirely yours.

- Verifiable: the blockchain makes it possible to verify something that is much more complex to demonstrate or certify with topics such as art collecting or stamps; for example, the blockchain maintains a history of who has bought or sold an NFT and who is its current (absolute) owner, including the original creator from whom that digital asset was purchased in the first place.

The Boom of the NFT space

At the moment of writing this, most NFTs created are associated with digital games and art.

The top-5 collections currently according to OpenSea are CryptoPunks, a digital art collection, with a total volume above 171,000 ETH; followed by Decentraland, a virtual world, with 98,000 ETH; then Rarible, an NFT marketplace with over 84,000 ETH in total volume; CryptoKitties comes after with over 66,000 ETH in total volume; and, finally, Sorare, a football digital trading card game with over 41,000 ETH in trading volume.

In total, the total volume of the five projects above almost reaches 500,000 ETH. At the current price, that’s over $1.5 billion in total volume.

If we now look at the past thirty days, the outlook is staggering.

NBA Topshot, a project from Dapper Labs, the home of CryptoKitties, is ranked first with over $568 million in trading volume.

CryptoPunks, Rarible and Sorare come next, with $337 million, $103 million and $70 million, respectively.

Nevertheless, we notice that most NFT-related applications are sprouting in the art space; what about financial applications of NFTs? Are there any?

Financial Applications of NFTs

RealFevr believes the most prominent NFT applications being developed will be born in the financial space. Let’s discuss some of the markets we think will emerge in the next few years in the DeFi space related to NFTs:

- NFTs Indexes: NFTs incur high risk. Because they’re unique, they’re less liquid. Therefore, we think NFT indexes will emerge from combining many NFTs into one NFT-backed token that will become highly liquid.

- Yield-Bearing NFTs: NFTs that can be collateralized. Hence, investors can lend them to borrowers for a yield. If the NFT is stolen, the collateral is given to the lender.

- Fractionalized NFTs: these markets will allow NFT owners to mint tokenized fractional ownership of their pieces, facilitating the buying and selling of percentages of the full NFT. Not only that, but NFT owners may sell portions of their NFTs, instead of the whole thing, increasing liquidity.

- Off-chain NFT Oracles: while NFTs are pretty awesome, it would be great if they could be used outside the blockchain. We envision a world where NFT holders will be able to use their digital collectables in various games that will accept them due to their unique properties.

Risks

While NFTs are exciting new tech, there are risks investors need to be aware of, such as low liquidity and an exponential risk of not being able to sell the NFT for a higher price, due to its uniqueness.

RealFevr NFTs: Changing The Game For Good

RealFevr is the most unique and experience-focused fantasy football application. Our mission is to provide players with the best fantasy game experience and to do that we have built a state-of-the-art application that runs on top of blockchain technology.

RealFevr is composed of a series of moving parts:

- Free Fantasy Leagues to play with family and friends,

- Video Collectibles that can be traded, collected and used to boost your teams’ players,

- FEVR Tokens that incentivize players to wager against each other,

- Token Fantasy Leagues to compete like pros,

- Other incentives, bonuses and deposit pools for players that lock-up tokens and lend video collectibles to other players.

RealFevr’s revamped business model will be based on video collectibles. It is within the marketplace that fans can buy packs, check their collections, trade, borrow and lend video collectibles to other users.

“RealFevr delivers the most immersive experience to all players, and enables a new business model where users can benefit directly from the $FEVR token ecosystem.”

Additionally, RealFevr collectables are protected by IP and cannot be duplicated by any other company in the world.

In summation, RealFevr delivers the most immersive experience to all players, and enables a new business model where users can benefit directly from the $FEVR token ecosystem, from using and lending collectables, and from sharing value with the in-game community.

Conclusion

There are likely hundreds of thousands of financial applications we cannot even begin to comprehend, that will most likely leverage NFTs beyond our wildest dreams.

Therefore, we aim at bringing all $FEVR holders exposure to this brand new asset-class that will enable them to collect the most unique and everlasting moments in football.