Ageing audiences: US television trends may soon be seen in China

October 3, 2017

A recent report of live sports’ TV audience in the U.S. from the agency Magna Global shows that while live sports consumption remains strong, its audience keeps ageing, and that’s troubling for advertisers.

Among the highlights:

- Younger fans have an increased interest in short-term content, like statistics and quick highlights, and the availability of that information has naturally funnelled some younger viewers away from TV.

- The median age of viewers watching the NCAA basketball tournament passed 50 last year.

- Thanks to the multicultural development strategy, the audiences of the NBA and soccer are still relatively “young”.

While there are still plenty of advertisers looking to reach middle-aged audiences, those that have turned to TV sports to reach younger consumer may have to start looking elsewhere.

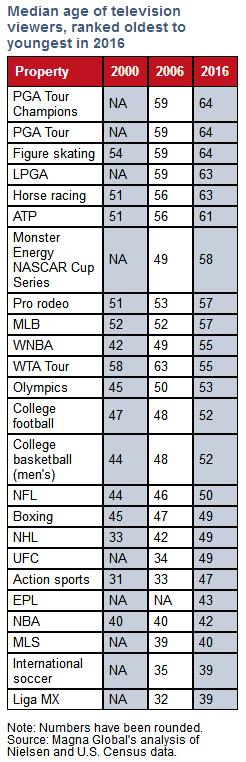

According to a striking study by Nielsen on television viewership data of 24 sports, all but one has seen the median age of their TV viewers increase during the past decade.

Based on that, SportsBusiness Journal co-operated with Magna Global and made a study of live sports’ TV viewers.

The study looked at live, regular-season game coverage of major sports across both broadcast and cable television in 2000, 2006 and 2016. The used data came from Nielson and the U.S Census. Before we starting looking into this report, it is crucial to acknowledge two additional pieces of data:

- According to Wikipedia, the average life span of U.S. population is 79.8 with male 77.5 and female 82.1.

- According to CNBC, in 2016, the average retirement age in most of states in American is 63.

Analysis of the trend of live sports viewers among USA in three dimensions

Generally, golf has the oldest when looking at the average age of TV viewers while soccer has the youngest. In addition, it showed that while the median age of viewers of most sports – except the WTA, NBA and MLS – is ageing faster than the overall U.S. population it is doing so at a slower pace than prime-time TV.

The trends show the challenges facing leagues as they try to attract a younger audience and ensure long-term viability, and they reflect the changes in consumption patterns as young people shift their attention to digital platforms.

- The NHL has seen its median age jump by 16 years since 2000.

- The WTA Tour is the only property to see its median age decline during that 16-year span, as well as over the past decade.

- The NBA has stayed fairly consistent, with the median age of viewers climbing only two years since 2000.

The change of the audience under 18

- 17% of Liga MX’s TV viewers were under the age of 18 in 2016, the biggest such share of any of the 24 properties measured.

- MLS is second with 15%.

- Golf brings up the rear with about 3%.

- The NHL saw an eight percent drop from 2000-2016.

- Only the WTA Tour and boxing saw an increase in its younger-aged TV audience composition over the past 16 years.

- Young viewers made up 8% of the NHL’s overall TV audience in 2016, down from 13% a decade ago.

- The Olympics, boxing and college football were the only properties to see an increase in its youth composition, albeit barely one percent.

The median age of viewers of most sports is aging faster than the overall U.S. population

The median age of the U.S. population was 37.7 years old in 2016, based on U.S. Census data, up from 35 years old in 2000. However, the median age of TV viewers of nearly every sport has increased at a higher rate than that of the population.

Only the NBA (median age rose by two years from 2000-2016, to 42) and WTA Tour (whose median age dropped by three years, to 55) have seen a change in median age that was less than the overall U.S. population.

These are the five big league markets that saw the biggest increase in median age from 2000-2016, and the five that saw the least change in median age.

While the sports television audience is ageing at a faster rate than the overall U.S. population, it is doing so at a slower pace than prime-time TV.

Through mid-May, the median age of viewers of such programming on ABC, CBS, Fox and NBC, excluding sports and specials such as political debates, rose by a range of 8-11 years compared to the same time period a decade ago.

“There is an increased interest in short-term things, like stats and quick highlights,” said Brian Hughes, senior vice president of audience intelligence and strategy at Magna Global USA. “That availability of information has naturally funnelled some younger viewers away from TV.”

None of the properties contacted contested the data, but most pointed to digital consumption among younger viewers, which was not included in the study and is growing rapidly.

Jeramie McPeek, former long-time digital media executive for the Phoenix Suns who now runs Jeramie McPeek Communications, a social media consultancy, also cited the movement of younger consumers to digital platforms.

“It is smartphone and tablet usage by younger people who are on Snapchat or Instagram all day long and watching a lot of videos on YouTube and Netflix,” McPeek said. “Rarely are they watching TV and they are on their device constantly where they can watch videos on demand.”

In the face of new trends, attitudes differ

While the MLS, NBA and some others may remain relatively optimistic after they read this report, events like the PGA Tour must study how to improve the sustainability of their audience.

- Soccer has the youngest on television, with a median age of 40 for MLS viewers in 2016, up from 39 in 2006. The PGA Tour has the oldest, as the average age of its television viewers climbed from 59 in 2006 to 64 in 2016.

- Four major leagues in North America: The NFL in 2016 had a median TV viewer age of 50, up four from 2006; MLB rose four years as well to 57; the NHL was up seven to 49; and the NBA was up two from 40.

The numbers highlight why so many sports properties feel a sense of urgency to attract younger fans.

“There are now so many different ways to engage with properties, and people are getting highlights whenever they want,” said Doug Perlman, chief executive officer of Sports Media Advisors. “People have to question whether younger viewers are less inclined to watch or less inclined to watch as long.”

Ty Votaw, executive vice president of global business affairs of the PGA Tour, had some different opinions and he summed up the tour’s demographics: “While we may be older, our demographics have been of considerable higher quality than other sports and we have aged considerably slower.”

Votaw also noted that audience trends today can’t be solely focused on the linear TV viewer and pointed to a younger audience on tour-run digital properties.

“When you go to PGATour.com, the median age is 55 and for our PGATour Live (over-the-top network), the median age is 20 years younger than on broadcast,” he said.

On the other end of the spectrum, MLS credits its younger average age to the game itself and its multicultural reach. 15% of its fan base is under the age of 18, the highest such rate of the U.S.-based leagues

“It is the coming of age of our league and the connection we have with multicultural millennials and with people who grew up with soccer as their first participatory activity,” said Howard Handler, chief marketing officer of MLS, which counts ESPN, Fox and Univision as the league’s TV partners.

“If you get into bigger trends, our game is a two-hour experience that isn’t broken up by a bunch of TV timeouts. We consider our TV deals to be progressive. We are the only league that has an exclusive Hispanic game of the week. Yes, we have a young demographic, but we have a lot more work to do. We are still driving scale.”

The NBA has the next-youngest TV viewership with a median age of 42, up from 40 in both 2000 and 2006.

“The youthfulness you see in the NBA is by design,” said Pam El, the league’s chief marketing officer. “Children start playing basketball at a young age and we have a strong youth program. Our players are pop-star icons and have strong appeal to young people. They have huge followings and young people follow young people. But you don’t just want millennials. You want to continue to keep viewers in all age groups.”

“We know that people are going to consume our content differently, not just through broadcast or on one device. We know how millennials consume content and we have developed our offerings to meet that demand. You go where they go and you will attract fans in that age group.”

The WTA is the sole property in the study to buck the trend towards older TV viewers. In 2016, the WTA’s median age TV viewer decreased to 55, down eight years from 2006. It was the only property that saw a drop in the median age of its TV viewers during the past decade.

WTA President Micky Lawler said that the increased social media participation by WTA players and the growth in the WTA’s OTT and digital offerings have attracted younger viewers to television.

“Our digital platform drives people to the linear live matches,” Lawler said. “We need to get to 35. We have a way to go.”

While the study shows the progression toward older TV viewership in sports, it does not address any specific changes in the number of sports television viewers for any particular property.

Magna data reveals that in 2016 the majority of properties saw an increase in the number of televised hours compared to 2006.

For example, approximately 354 hours of live MLS action aired nationally last year, up tenfold compared to a decade prior. Only boxing and the PGA Tour Champions saw their number of TV hours decline between those two years.

The trends taking place in the United States may soon be seen in China. Broadcasters and advertisers should get ready for rainy days.

Lanxiong Sports is the first sports business content provider in China and has become the first multi-service platform of the industry. Click here to see what we are doing.